by Hope

Last week I wrote about how my recent research into single moms and money, single moms and debt and so forth had really hit home with me. It opened my eyes to so many things.

I pride myself on being pretty smart, book smart, that is. But I’ve come to realize I am far from healthy as far as mentally and emotionally. The history of abuse, living in crisis mode and just the personality I was born with have created an unhealthy Hope as far as that goes.

But I’m proud to say, my eyes are open now, I’m aware of the problems. And don’t they say, the first step in recovery is acknowledging the problem.

Taking Baby Steps

I’ve got a lot of work to do. Work on myself, work on my finances, work on my decision making and so on. And I know I can’t do it overnight, fix it overnight.

But I’ve begun with some baby steps, some which I think will have far reaching affects.

Physical Self

I have diabetes. This is not really news, it runs in my family and bloodwork last fall confirmed it. But I’ve been ignoring it.

In fact, other than going to a neurologist for unbearable pain last fall, I haven’t been to the doctor in 10 or so years, I guess. Taking care of myself has not been a priority at all. It’s always been about the kids.

I now realize that in order to take the best care of them, and set a good example, I need to take better care of myself. So today I went to the doctor. And I told her, I need help with my diabetes.

Blood work and labs ordered, follow up appointment set. (The good news is that I am officially down 12 lbs since January, and that’s without effort other than changing my eating a bit.)

I am determined to get my diabetes under control, my weight under control and take better care of my physical self.

Mental Self

While writing about everything going on have been very cathartic. Doing it alone is not healthy for anyone. I am seeking counseling to address a number of issues…and I’m sure they will find more.

Readers here at BAD have really been instrumental in getting me to this place. Pointing out things that I didn’t recognize in myself. The tough love.

Things I know I need to work on especially are my: aversion to confrontation, being reactive instead of proactive and a slew of other issues that I have buried deep. I saw this image on Facebook this past week, and had another “aha!” moment.

Financial Self

My reality is that we are a single income family. I didn’t choose it, I didn’t prepare for it. But it’s what we are, and I MUST start learning how to embrace that, choose that and most importantly live within the constraints of that. No one is coming to save us, no one is going to bail us out.

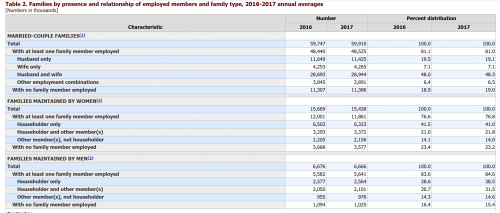

According to the Bureau of Labor Statistics, 48% of married couples are two income families. While single mom homes, only 21% have a second income and it doesn’t specify but that may part time. (Click on chart below to see full report.)

The point is that many choose to be single income families despite the hardships they may face in this economy. While I may not have had that choice, it is certainly not insurmountable.

With planning and sacrifice, I don’t have to keep living paycheck to paycheck. Barely making ends meet, and constantly robbing Peter to pay Paul. Make sense?

I need to study how they do it, succeed at it. I referenced my current studies in my recent post about Financial Realizations.

My question for you, BAD Community, is how do you prepare for something like this when you are already in the midst of it? While the experts say do X, Y and Z before you take the leap…I’m kind of working backwards from that.

What resources would you recommend as I continue to study how to live abundantly as a single income family? They say knowledge is power and I am ready to be powerful, I have lived far too long feeling weak and in fear.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

This is major and important work! Good on you for doing it. I truly believe that dealing with these underlying issues is what will make you most successful.

Thank you, Kate. I agree with you.

I am just flabbergasted at some of the things I just didn’t notice or didn’t think about. Putting all the pieces together and really looking at the big picture has been both frightening and empowering…

Despite all my screw-ups and there have been plenty of those, we are still here, still moving forward. And hopefully, I’ve not caused irreparable damage to my children.

I appreciate your comment more than you know!

~hope

To answer the question, I think you may need to treat it like a totally new problem. Approach it as a new work assignment. You may need fresh eyes. Then, take the steps you would to complete a project. Develop goals, an implementation plan, a milestone chart. Build in assessments. I’m glad you’re making your health a priority. When I was growing up, my mother took a walk every night after dinner. We could join her, but she often went alone. I’ve started doing the same. It’s a little bit of exercise, it can give you space to clear your head, and if the kids join you, it’s a good chance to connect.

I don’t understand your question. You can’t prepare for something when you’re already in the midst of it. You’re either preparing for it, or you’re in it. That’s just fact. Like, you can’t go both left and right.

I think what you are doing right now are MAJOR steps to making yourself healthy. I am not a single parent but we are a one-income family and I am dealing with the same things you are right now. I have been reading a book called “Letting Go of Debt” by Karen Casanova that I originally checked out of the library, but ended up buying on Amazon (used a gift card, lol) because it just spoke to me. I am not a “religious” person so to speak, more “spiritual”, but this book is basically about forgiving yourself for the situation you got into, letting go of the guilt, anger, etc., and moving on to deal with and get rid of the debt. I’m also reading the book by the guy who started YNAB – “You Need a Budget” by Jesse Mecham (ALSO bought with a Barnes and Noble gift card, lolz). Two books that really spoke to me…

Hope,

All of these realizations are important. Certainly things have not been easy for you.

At the risk of sounding unsympathetic, I just want to make sure you don’t “whitewash” other, very basic, aspects of fundamental financial decision making. Yes, you may be book smart, but you still charged $2k+ for computers on a credit card not so long ago. Just a couple posts ago, you described $60/month in interest charges on the credit card debt as “not much money” (paraphrasing). In fact, it took several BAD reader comments before it was clear that this interest was in fact accruing at all.

At this point, it seems there can still be a lot of room for better financial choices. But of course I also want to acknowledge that you have made very dramatic changes just in the last year or so (public school, etc) that I think will help you out in the long run!

Hi Hope,

Glad you’re piecing together the puzzle!

Like you’ve said acknowledging is the first very important step.

To me it seems like plenty of people kind of saw the situation like you’re seeing it now a long time ago. (I might be wrong with that assumption , but it felt like a lot of people have been trying to point you into that direction, to take care of yourself, to make yourself a priority, to set a good example, to not let others take advantage of you etc.)

So it’s great that you came to that same conclusion.

I really like Katie’s suggestion.

I guess maybe don’t try to tackle too many things at once. Try to incorporate one gut habit for a couple of weeks and once it feels naturally add another one and so on.

Also don’t beat yourself up if something doesn’t stick immediately. Changes need time.

One step at a time.

You can do it

Kili,

You are certainly right. I sometimes need a “frying pan to the head” to get me to see something that is obvious to others. I have many, many example of that in my life.

And thank you for the encouragement, it is all about baby steps right now. Too much definitely overwhelms me at this juncture.

I think the biggest thing you can do financially is create and maintain a budget. Not a one month budget, but a 12 month budget. I know this will be hard on the income side, as that fluctuates. But the expenses should be determinable. Once you know those, you can see what you have to do in terms of income to get to a better place. Be sure to include EVERYTHING, and estimate for anything unknown. Keep the same budget document for multiple years and assess afterwards where you were off from plan, that will help you plan for future budgets. After each month – compare what you had estimated, and how you ended up in terms of both income and spending. After only 2-3 months you will be able to see a pattern if you are consistently over or underestimating. I hear the Every Dollar from Dave Ramsey is good, and its free. Good luck!

Best thing to do when you’re in the middle of it is to write down every penny spent. I suggest doing this on physical paper to add impact. If you’re to a point where you have enough work to cover your expenses, build up that emergency fund. Aim for $2k and then $10k.

Make incremental progress everyday.

Thanks, Walnut. I have been religiously tracking every penny spent since reading “Your Money or Your Life.” It’s amazing how much just keeping that record has curbed my spending and made me think about every decision twice.

I’m going to stick with the $1,100 emergency fund I will get from my Self Lender account in September as my EF for now. And focus on paying off debt while keeping that intact. At some point, I will need to go into saving mode, but I feel like I did so much of that last year that I didn’t make headway on my debt and with the job loss those monthly obligations are killer.

Hope,

I have followed you for quite a while now but have not commented. I am also a single parent now and going through many of the same things that you are. While some of our paths are different, many are the same. I just wanted to tell you to keep it up, don’t lose faith in yourself. You know you can do this! The more you get a grip on your health, emotional and physical, as well as your finances, you will find peace in your life.

Thank you, SassyGirl. I really appreciate the encouragement.

Most people are in the midst of it, life doesn’t slow down or stop when we realize that changes need to be made. I’ve not met any single parents who say “Yeah I took this long to get my life straight before jumping into single parenthood.” All of us got this thrown on us and had to course correct in the midst of it.

Decide what you want your life to look like. Allow yourself to hope and dream. So much of this is eliminating those self-limiting beliefs we have because of what happened to us. When you have a long range goal in place, start seeing the small things you need to do now. But the biggest thing is to take action. Don’t just plan, start.