by Hope

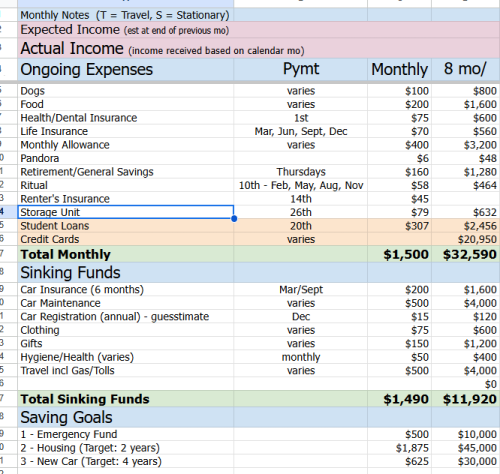

I am so grateful for all the feedback and education and tips on my new budget. After 3 4 rounds, I am feeling pretty good about this. And I’m determined to do better at tracking my spending and being held accountable. Still figuring out what that is going to look like. But here is where I have landed after all your notes.

You will note that there is a new category: renter’s insurance. It will cover all of my items with me, in Princess’ apartment, and in the storage unit. It’s tied to Princess’ apartment address as I am a legal tenant there. And I upgraded some coverage to cover my electronics which I haven’t done before. I figure with travelling and such, it would be best to have good coverage just in case.

It technically won’t cost me anything for the next 12 months because I am getting a significant refund from my homeowner’s policy, over a $1,000 but they said it will take two billing cycles for me to see that money.

I have to be honest. Playing around with the formulas, pivot tables, and different data manipulations in a spreadsheet is something I truly enjoy. And I’ve learned a lot from this process.

Business Next

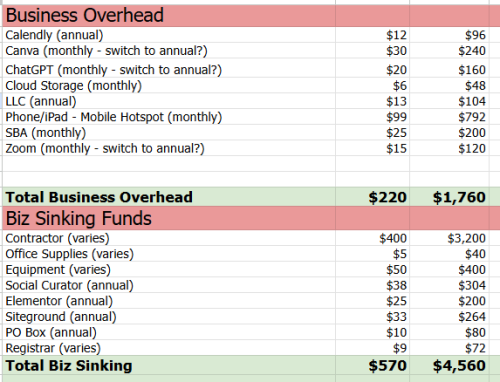

Now I’m going to work on doing the same type of budgeting for my business. Here’s where I’m starting:

Now that work is steadily paying the bills again, I want to tighten things up. Switch some of the monthly costs back to annual (says 15-20% typically).

I’ve also got to work on transferring everything to Texas. My LLC is already registered in GA through the end of the year. I paid for 2 years back in 2024 so didn’t have that expense this year. So I feel comfortable taking my time to figure out the logistics and costs, but definitely need to handle by the end of the year. (The numbers above for those things are guesstimates based on GA costs and quick Google searches.)

And like my personal budget, this is an 8 month budget, just through the end of 2025. I don’t feel like there is any “fat” on this right now. But I will definitely be spending some time evaluating it once I get settled in Texas.

Thoughts?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

So, what do you think ?