by Hope

We have now made it past the second contingency period. The inspection has been reviewed and accepted. The appraisal is done. The closing date is just a couple of weeks away. I’m sure you all know that I’ve been playing with the numbers for months now.

But I still don’t know how much I’ll actually take away from the house sale. However, I’ve got a solid plan for where the money will go. Obviously, the house will be paid off. The total for that pay out will be around $127,000.

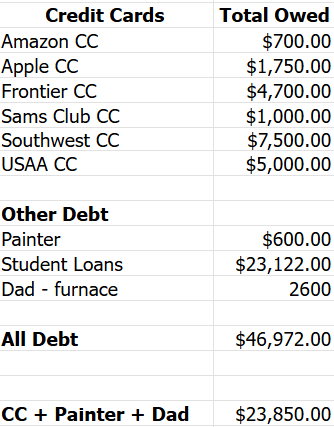

First, the painter will be paid the remaining $600 I owe him.

Second, I will repay my dad for the loan from January, 2024 for the new furnace.

Third, I will pay off ALL of my credit cards. All except three of them will be closed. Eliminating the temptation. I will be leaving my Apple CC, Sam’s Club CC, and USAA CC open. They are already locked (and maxed out so the lock doesn’t really do anything.)

Between, these three items, $23.850 will be spent.

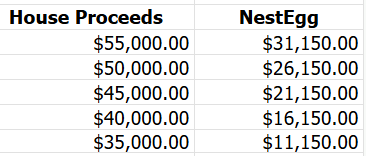

Based on my guestimates, that will then leave me with a nest egg of…

I do not plan to rush to pay off my student loans. At this point, they will be my only debt, and I’m comfortable with just starting to make regular monthly payments.

I have several other things I’d like to do, but I think the best thing would be to:

- Put at least $7500 in an EF. That would be essentially 3 months of living expenses should something happen to me/my work.

- Pay my car insurance through this 6 month period. My auto insurance is my highest monthly bill. And while there is no interest to make monthly payments, I’d like it to be paid. Then I can “pay myself” monthly so when it renews in September, I can pay it all at once. This is just a peace of mind thing vs a financial thing.

- The remainder will be used to jumpstart my Move fund in a high yield savings account.

I’m certainly open to feedback.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Above, your credit card debt is just over $20K.

On Feb 28, you reported it was $15.8K. https://www.bloggingawaydebt.com/2025/02/no-debt-update-why-3-months/ And that in itself was a major increase from the prior update.

You are counting the windfall proceeds from this house sale, but at this rate the money will be gone before you know it. How can you possibly avoid addressing the reasons for your spiraling debt?

It’s not that hard to start. Take your new ‘budget’ file, and fill in ACTUAL income and ACTUAL spending for Q1. Please, take control of your spending habits before it’s too late.

You will note there is a card that has never been listed before.

The bulk of the debt from Q1 is from business expenses, taxes, social security, etc. I was hoarding the little bit of cash I was making to cover personal bills and put as much as I could on my business CC. It will be cleared with the house sale.

Your concern is valid, but I guarantee this is a completely fresh start, new perspective for me. Going from supporting a family of 6 to just ME!

Hope this is a troubling comment.

I’m not sure you understand what you are really telling us with this business expenses reasoning. Business expenses would affect your business’ profitability and therefore decrease your personal income from that business. You can’t have it both ways: to think of gross payments coming in as personal income, but also try to explain some portion of personal debts as business expenses. If you put business expenses on a personally secured line of credit, then in context of your personal finances you made a choice to sink your money into an unprofitable business. I understand you have been in a bad spot lately and there was a practicality to what you did, but there is also a longer term problem with business accounting.

It will help you get a better handle on personal income if you have business expenses flow from gross business income, then you pay yourself. If the problem is that Q1 is expense-heavy for your business, a budget with sinking funds for the business can solve that problem.

First sentence sounds a little petulant TBH. And does it mean that you have been concealing a credit card or that you opened a new card since the last debt numbers? Neither actually counters what AS is saying above.

What is the benefit of having 3 credit cards still open? Do the cards alleviate some kind of financial burden elsewhere?

For one, I don’t use my debit card at all. I’ve had my account wiped out multiple times over the years. So first, it’s a security thing.

Second, auto-pay! Since I don’t do ACH/debt, being able to set up bills on autopay takes the pressure off. And let’s me track/forecast my money very easily.

Finally, travel. Not only do I get points. But you can’t rent a car without a credit card (not that I do that often), extra insurance is built in, and so many more travel benefits.

There are a few other reasons. But this is the bulk of it.

But that’s not what jj asked. Sure, there’s justification for having a credit card, but you completely ignored the question about why you have THREE of them open.

Why I’m leaving these three cards open:

1. Sams Club – we use Sams for everything and my kids share my membership. The card points covers the cost of the annual membership. And when travelling it saves a ton on gas. It can only be used at Sams/Walmart. Since I won’t really be traveling or buying groceries for most of the next 8 months, it will only come into play when I do travel.

3. USAA – has a decent credit line ($5,000) but not excessive, is my oldest card (thinking credit score), and when I need to buy something larger this is what I’ll use.

4. Apple CC – is my autopay card, low limit ($1,750), only card on my Apple pay for when needed.

That is why I’ve chosen to keep these 3. All others are already cut up and will be closed as they are paid off.

Are you ever going to pay off your student loans? I agree with the EF and car insurance but you are potentially putting $20K in a “move” fund when you could almost wipe out your student loans and be truly debt free later this year.

I will be “houseless” and while I’m excited about the adventure. Should something happen with my health or my parents, I would be in a tenuous situation for a homebase, an address, etc. Having a robust housing savings is important to me. Even if I don’t go the land/tiny house route, it would be great to have a year’s worth of rental/apartment money ready when the need arises. That is the mindset behind the housing savings account.

Hope,

I like where you are going with this. Seems you need concrete numbers to know where you are going to land with the house sale. I encourage you to get those sooner rather than later but I understand things can change a bit. I like that you are planning it out with different options here.

I love the 7500 in an emergency fund. As long as you USE IT THAT WAY! I say that because as you know from my prior comments I have had difficulties with self control in the past with large amounts of money. I suggest not having a debit card for the account you put that money in and putting it in a separate bank where you have to drive to a branch to pull it out. Still easily accessible but not so easy you can do it without a good reason. At least for the first year or two while you break habits.

I too would pay off the car insurance just in case. Financially it’s not a good move because strictly speaking you are paying interest on your student loans and you are loosing interest if you put the money into investments. However, those of us used to variable income understand that decision. The key will be actually paying yourself every month and not being tempted to spend the money on other things because it doesn’t HAVE to go to bills.

I encourage you to consider bumping that ETF to 10k if you can. It’s a nice round number that you will not want to touch and gives 4 months. Psychologically going below that 10k mark is very hard for people once they get over 10k. It’s weird, but it helps with self control.

Hope this helps!

I appreciate the feedback, and I a1gree the $10K EF would settle me mentally a bit more. And remove that from my savings goals.

I have gotten pretty good at removing access to accounts.

And opening a couple of new accounts outside of my day to day, and harder to access is definitely on the list of things to do.

Wishing you all the success, but I honestly would put something towards your student loans that moves then in the right direction for motivation, maybe $5k. Then, any deferred medical cost needs? If not, put the rest in Savings.

How are you so close to closing and are not sure how much the sale will be?

I know the selling price, the closing costs I am paying, and the buyer’s agent commission. But I have no clue on any of the other fees. Online says they could range from 5-15% of sales price. So this range has let me “play” with numbers and plans. I think I will wind up with about $50K-ish.

In Dec, your credit card debt was about $6k. At the end of Feb, it was $15.8k. Now, less than two months later, it is just over $20k.

I never commented on it then, but I guessed the for $9k jump was due to paying rent for your daughter for multiple months. This time, I’m going to go with…paying for a wedding and a graduation party.

If this $15k of additional credit card debt in less than four months is your living expenses, this is bad, bad sign.

I am very proud to say that I have not spend a single dime on wedding or graduation!

I will be. But no, none of my debt is from that.

The bulk of it is taxes and business fees. With significantly lower income Jan-Mar I put business expenses on CC to hoard my cash as much as possible.

And one other thing.

‘Eliminating the temptation’ to use credit cards by keeping open…*checks notes* – half – of them is like an alcoholic saying they will stay sober by keeping a 12 pack of beer in the fridge that’s left over from a case.

Why is there such a large gap in how much you expect to net? I don’t understand why you don’t have a better estimate if the contingencies have been cleared and the buyers haven’t asked for anything.

This is a cut and paste from the spreadsheet I’ve used to “play” with numbers. I believe I’ll walk away with right around $50K at this point.

There was so additional negotiation. And we are in the home stretch. But I don’t know how much lawyer fees, taxes, and other misc fees will be.

I think this is probably the most honest you’ve been with numbers ever.

I agree with your $7,500 emergency fund. However, you need to put that in a high yield savings account, too. It does NOT need to be readily available for you to spend. The MINUTE you get whatever pay out from the sale of the house, you need an online savings account. I use ally (like what was mentioned in the post you linked). It is very easy to have ‘buckets’ of money there, savings goals, etc. Whatever amount you decide to keep – toward whatever other savings goal, you should put into a CD with them because the CD’s have a moderately better interest rate.

Yes, please pay the car insurance six months at a time. It costs less that way. Maybe not a lot, but a little bit at a time adds up. I used to read a blog where the woman had virtually nothing. But was spending money on coffees and different things. I can remember her saying, “it’s just a dollar.” But it’s never ‘just’ a dollar. Especially in the situation you’re in right now, frugality needs to be your best friend.

Get up in the morning, spend your time in the Bible and in prayer. And then spend five minutes making a list, pondering, studying, or something having to do with saving money. Review what you spent the day before. Plan what you are going to spend that day, that week, that month. The more time you spend in God’s word, the closer you are to Him. The more time you spend thinking about frugality, the closer you’ll get to being frugal.

I agree with all of this, and appreciate the personal recommendation for Ally. Setting up a high yield savings account is on my list to do mid-May once the dust settles from the sale and move.

So the reason for the jump in debt is due to business expenses and taxes. What real expenses do you have that amount to that much? You don’t have rent for example? And don’t you claim to set aside money for taxes when you earn it? My suspicion is that these are just normal expenses you put on your CC. If you don’t change your habits, you may be able to pay off what you currently owe but you’ll immediately be back in the same situation plus be homeless. The mismanagement is just really shocking. You don’t need to be spending a penny on anything that isn’t 100%! Necessary, and I would also recommend you get a job with a paycheck.

Even working fast food, you could cover what should be minimal expenses.

Because my income was so far down for Q1, I hoarded the cash and put quarterly taxes, etc. on credit.

And I did have a job in fast food; unfortunately, the hours/pay were dismal. I can’t take on a cashier job or anything customer facing in a public space due to my hearing or rather lack of hearing.

That is an excuse, and a load of bull. I lived adjacent to the town with a deaf school (public k-12 school for deaf and HoH kids). I went there often. There were a LOT of deaf and HoH kids who worked the counter at the fast food places.

Perhaps if I had been born deaf or hard of hearing I would have developed the skills to ‘hear’ in loud places – reading lips or whatever.

But I don’t have those skills. I cannot hear in public places, taking orders would be disastrous. I can’t hear waitresses when they come to a table to take an order. I can’t even hear my own doorbell anymore. If it weren’t for my dogs, I would never know when someone comes to my house.

I’m glad these kids have a different experience.

And just so you know, unless you have walked in someone’s shoes or experience what they experience, kindness would be the preferred way to communicate your question vs judgment.