by Hope

I’ve become far less concerned with my credit score since I purchased my house last year. But I still do follow a couple of credit repair or best practice experts and based on their advice and posts, keep an eye on what I’m doing. One of the things I see consistently is to make multiple payments a month. This not only positively affects your credit score, but also cuts down the interest you are paying.

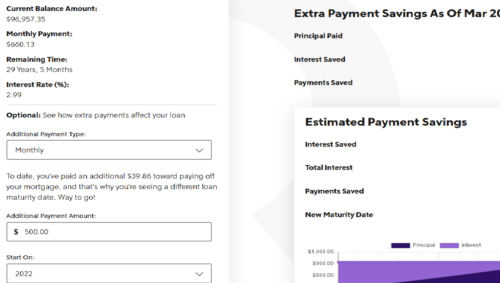

Even my mortgage company offers this as a pre-set option, essentially breaking my monthly mortgage payment in two. Instead of paying $660 per month, I am paying $330 every two weeks. (I love playing with their amortization calculator to figure out how extra payments and such affect my mortgage in the long run.)

While I don’t have to “worry” about my credit score anymore with no need for credit/debt, I do still want to improve it while at the same time continuing to climb out of debt. I doing pretty well at other strategies like keeping my credit card debt under 30%, easy to do when you are paying it off every month, not applying for new credit and paying bills on time.

I guess my question is twofold:

- Does doing bi-monthly payments, specifically on your mortgage, really make that big of difference in the grand scheme of things?

- Does doing bi-monthly payments on other debt do the same thing? (I know it won’t make a difference on my medical debt as those are interest/fee free.)

I’d love to know if the strategies these experts harp on real or if they are just blowing smoke. No, I have no need of a credit repair service. But I am still working to gain knowledge.

I would love the BAD communities thoughts on this strategy that seems to be a positive for 1) decreasing the interest you pay in the long run and 2) increasing your credit score somehow.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

When you send the first half of the payment, do they immediately apply it? Or do they hold it and apply it when you send the second half? It probably doesn’t make a huge difference be given your low interest rate and relatively low payment. It can be helpful though with evening out your cash flow.

And easy way to start, if you want to pay off faster is to round up your payment—like $350 twice a month, or $400 twice a month. But make sure that the extra goes to principle!

We did that when we bought our home 29 years ago. We did a bi-weekly but only a 10 mortgage. We only saved 2 years but have heard that it can really knock off years in your mortgage. Most banks here don’t offer that but our local one did. We had to open a checking account and they automatically took the money every two weeks. You will also pay two extra payments a year.

A payment every 2 weeks adds up to 13 “full” payments a year—so one full payment extra. This is why you save interest and reduce the payment terms. You should never pay for this privilege (some places charge fees for this) and the extra payment should not go towards future interest, but clearing already accrued interest and paying down principal.

For revolving debt like credit cards, paying early and often reduces interest as it accrues daily. For fixed debt like mortgages, it depends on your terms and servicer. Our first mortgage only calculated interest monthly so early payments did nothing, but when we refinanced, they calculated interest daily from the last payment so earlier payments were less interest (but only if you got earlier and earlier).

For credit scores, lower utilization is best so paying often can lower the average balance (or decrease the chances of the high balance being reported).

If you’re doing a a payment every two weeks, it’s not really bi-monthly, it’s 26 payments a year, so you make 13 ‘months’ worth of payments per year. You’re mostly making a difference because you’re using that extra payment toward principle each year. That’s what’s doing the work, not because you’re paying more frequently. You can do this yourself on your own timetable if you so chose to do so.

In fact, the serving companies tend to make it easier to go this route with them because they get to hang onto your money (most have fine print that says they don’t actually apply your money exactly as you send it) and try and collect a bit of interest off it before applying it to your mortgage.

This also means it likely has no effect on your score as you aren’t really doing multiple payments (they tend to collect your money and batch it into a single payment). My understanding is that multiple payments only really helps with revolving credit lines as it can cause you to show a lower balance, and thus lower utilization at the end of the month, but other than that I don’t see how that helps other than just paying down debt faster.

Make sure your mortgage company is applying the payments at the time you pay them. If that is the case you are saving some in interest. If not, it isn’t doing anything for you. If you were paying every two weeks it would be different, because you would be paying basically an extra payment each year since that would be 26 half payments versus 12 full payments. Also, make sure you aren’t being charged for playing two times per month, some charge a fee for that. It is better off to round up each full payment monthly with as much extra as you can pay so you are adding to principal payments (you may need to confirm the extra is to go to principal, versus paying ahead on the next payment). If you have an “escrow” account for taxes, pay VERY close attention to it. It may not pay any supplemental tax you owe from closing and they are notorious for not paying taxes on time, and you have no recourse really.

I just have to say it’s super frustrating that you wait so long to approve comments and don’t reply. People have very good questions/comments and you don’t take the time to respond.

I can appreciate that. Unfortunately, this is an “extra-curricular” for me versus a source of life so I don’t sit on this site very often until I have some free time and that has been super limited in my life lately. I will try to do better.

You definitely would save on interest. Also, if you are truly doing it every two weeks, you’re actually making a full payment more yearly. It’s 26 payments a year, which equates to 13 monthly payments. It’s just like when you get paid every two weeks, there are those months where you get paid three times instead of two. Same thing.

Other things, it depends on how your interest is calculated. Like your student loans, it accrues daily, so yes making more than one payment a month will help with that. Things like your credit cards, they look at it at the end of the billing cycle, so there’s not much difference there.

Even if you aren’t too worried about you’re credit score, it’s always a good thing to keep up with. Good thinking.

Anyone who is paying back a loan or credit debt really needs to be tracking their payments in their own amortization schedule in Excel. I’ve harped on this several times and it is especially important for credit card or other high interest debt. That would tell you exactly down to the penny how much your extra payments are saving. How else would you know if your payments were applied correctly? In a way, by not tracking, you’re assuming the bank has your best interest at heart which is laughable.

I find it crazy how this is a debt blog, but neither Hope or Beks appear to know and apply basic financial math.

Gee whiz, Angie!!

I don’t think that your last remark is very nice.

Perhaps one of the reasons (another being behavioral) that they are in debt in the first place is that they have lacked an understanding of some of the principles of finances! They are trying to find help here–not be financial educators themselves.

Janie B.