by Sara S

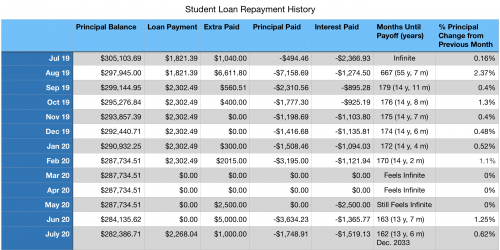

We made our first automatic student loan payment last week for the first time since we entered forbearance in March for the pandemic. It went through on the 22nd like usual, but I noticed afterwards that it wasn’t the usual amount.

Instead of $2,302.49, it was $2,268.04. I guess we should be grateful it didn’t catch us off guard by being more, but why $34 less?

Re-Amortizing Win

I contacted Earnest, our student loan company, to understand why. They said, “Our servicing platform will re-amortize loans that have any sort of payment protection applied, such as forbearance, deferment, skip-a-pay, etc. This is to ensure the minimum payment does not cause any borrower to make more payments than what was chosen in the original loan agreement, essentially exceeding the terms of the loan. Since you had forbearance for a few months, your loan was re-amortized upon exiting forbearance.”

Ah, gotcha. But here’s what they wrote that made my heart sing: “However, you’ve made extra payments which meant that your minimum payment didn’t increase like it does for most people who miss payments, but rather decreased.” It’s nice to know that this forbearance didn’t make matters worse for us!

I’m going to change our auto-pay back to $2,302.49, and keep trying to make extra payments each month. But all this got me thinking about payoff dates.

Calculating Exact Payoff Dates

I use a calculator on NerdWallet.com to see how many months until payoff. I wondered what would be the difference in payoff time if we went with that lower number and made no extra payments. After all, it’s only $34.45 difference. And this time, I figured out WHICH month of WHICH year.

Our principal balance is currently $282,386.71.

– If we paid $2,268.04, the payoff date is in 165 months, or March of 2034.

– If we paid $2,302.49, the payoff date is in 162 months, or December of 2033.

So three months. Not a huge deal. Heck, last July we were still making infinite payments, only paying off interest and rarely any principal. By August 2019 our payoff date was down to just 667 months, or 55 years, 7 months. We would have paid it off in 2075 when we were in our 90s. OH MY GOSH.

But in the end of 2033, we’ll have a 23-year-old, 21-year-old, and 19-year-old. Our kids will be moved out and we’ll be in our 50s. I know it’s better than being in your 90s, but I just don’t want to wait that long to be student loan debt free!

Moving Up that Payoff Date with Extra Payments

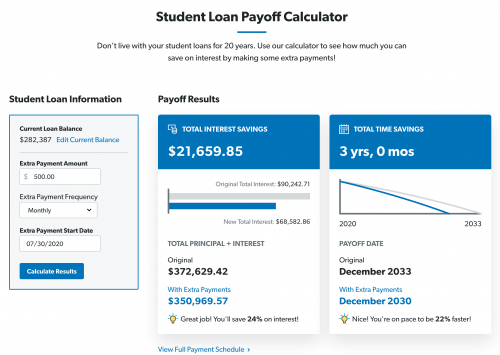

I found this cool calculator on DaveRamsey.com that unlike NerdWallet, it includes the month and year of your loan’s Payoff Date. It will even produce your Full Payment Schedule. The greatest part, I think, is it also calculates what happens if you make extra payments. It compares your current timeline to the extra payment timeline.

So I calculated what would happen if we paid $500 extra each month on top of the $2,302.49:

We’d pay it off 3 years earlier in December of 2030, and we’d save $21,659.85! Dang, ya’ll.

Knowing the actual payoff dates makes this more concrete and real. I’m feeling a fire lit under me right now. I don’t want to be messing with this loan in the 2030s. We’ve already shortened our payoff schedule, and now I want to shorten it even more.

You should download a loan payoff excel spreadsheet to track your loan. They actually have a template online direct from Excel you can use. https://templates.office.com/en-us/Loan-calculator-with-extra-payments-TM06206283

It’s really good to have a double check if your payments are being applied correctly, especially if you have a lender with a poor track record. The good ones allow you to input variable interest rates and variable extra payments (different each month). It will also keep track of your progress.

I made one myself that can accommodate extra payments mid-cycle, and multiple loans, since I’m an Excel geek. I actually have a copy dating back to 2007 when I first graduated. It’s interesting to see how my payoff and mindset changed over time. It’s also disgusting to see how much interest I was paying at the beginning of the journey!

I made one myself that can do variable interest and variable extra payments (different each month). I’m sure there are others online.

That’s a great idea. Thank you. That is right up my alley!

You can do it. What are your degrees in?

Thank you! Mine is in English, his is in healthcare.