by Beks

Remember the post where I was upset because I felt like I was being called a financial moron for letting my emergency fund dip from buying a new trailer while I waited to sell the old trailer?

Whelp. I’m circling back to say…it was a bit moronic.

Here’s the deal. I don’t think letting my emergency fund dip from 6 months to 4 is a terrible thing. It’s still within the ‘acceptable’ range and if a real emergency happened during that time, I could have had a ‘fire’ sale on both trailers and been made whole nearly instantly. That said, I felt a larger sense of urgency to get rid of the trailer than I would have otherwise. Had I used a larger portion of my emergency fund, I would have been in an outright panic.

Panic is never a good place to be when selling a vehicle.

We spent many weekends and late nights showing the trailer because the thought of limiting the hours for viewing might make us miss the sale. I advertised everywhere and management those ads was a hassle. My phone was ringing non-stop. I even considered delivering the trailer to a property off a rough dirt road 45 minutes from my home which would have been a liability nightmare.

How Long Did it Take to Sell?

It took four weeks to sell the trailer and we ended up getting a little less than we hoped (but still within the planned amount). We had another offer on the table for more but decided to go with the lower offer. I swore that I’d never take a lower offer just because someone had a good story but… that’s what happened.

Karma Makes Me Eat My Words Often.

We had the choice to sell the trailer to a single guy who was going to live in it who offered full asking price or sell to a retired couple who shared their desire to take their grandkids camping. Our trailer has been such a huge part of our lives and we’ve made so many special memories in it for the last few years that I wanted someone to continue that tradition. I know it’s an inanimate object. It doesn’t have feelings. But I couldn’t stand the thought of it parked somewhere. It’s our gift of adventure to their grandchildren.

What Was the Lesson?

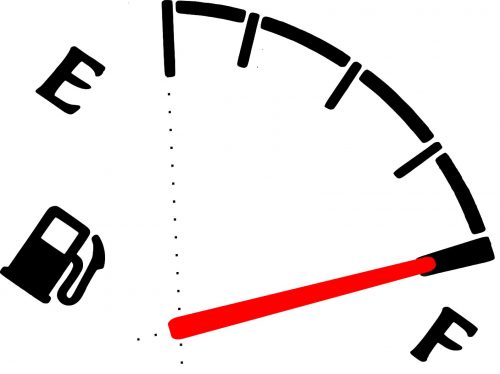

I did receive some great ideas on how to avoid this predicament in the future. It seemed silly to have a fund in addition to my emergency fund for these types of situations but the more I thought about it, the more it made sense. We decided to start that fund right away… well… next month. This month our account is running on E. But hey, at least my emergency fund is full again. Whew.

Thank you for the suggestions. It was an interesting lesson to learn.

Beks is a full-time government employee who enjoys blogging late into the night after her four kids have gone to sleep. She’s been married to Chris, her college sweetheart, for 15 years. In 2017, after 3 long years working the Dave Ramsey Baby Steps, they paid off more than $70K and became debt free. When she’s not working or blogging, she’s exploring the great outdoors.

Beks,

Great to hear all around. I’m glad you are going to start this additional fund. This is really a key step in getting to the next level of financial security and sophistication. Also relevant to Hope’s post about overdraft protection from a couple days ago.

Essentially at some point you should have: a buffer in your checking account (similar in amount to a “classic” emergency fund, say $1000). A real, substantial emergency fund of about 6 months expenses. And then “actual savings” that you will live real life out of, as well as save for longer term objectives (cars, down payments, college, etc).

Once you’ve lived with that level of financial stability for any amount of time, the motivation to stay out of debt should be so strong and deeply ingrained that it will naturally curb a lot of spending impulses.

Seems like you are doing great!

At the end of the day, you learnt a lesson and you are not hurting $$ wise – but I want to say no one called you a moron, so don’t call yourself that either! At the end of the day we are strangers to you, our opinion is free.99! Even if we were right, you have to do what works best for your family 🙂

Have you and your husband determined what you will consider a financial emergency in the future that would justify dipping into the emergency fund? I definitely think spelling out some parameters before you need to use it can help when the time comes to actually consider it. One of the goals of an EF is to not have to panic when you have an emergency that costs money, being on the same page of what in your family constitutes an emergency can help to determine if this is the fund to use in the moment.

I really like the idea of having a non-emergency slush fund as well. I am not sure how often you would use it for big ticket items such as this, but if it makes you feel better then a good route to go!