by Hope

My health was brought up in several comments over the last couple of weeks. And I certainly understand how that relates to money. Bad health can be very expensive. Thankfully, over the last year, I have gotten my diabetes under control beginning with medication and now with diet only. Yeah!

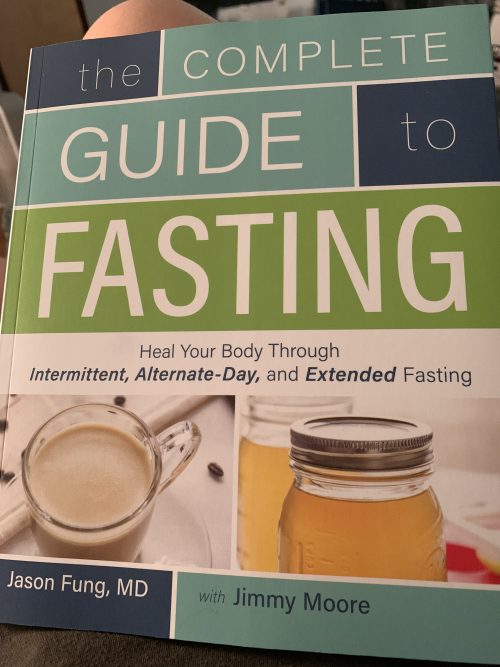

One of the keys to this big health change for me began with learning about the Keto eating plan. And then later on starting the habit of intermittent fasting. I’m not looking to start a debate on diets and low carb vs high protein. Everyone’s body is different.

For me, the combination of a Keto based eating plan and intermittent fasting has been a game changer. Not only have I lost 45 pounds in the last year without really trying, but my numbers are great! (As I diabetic under doctor’s care over the last year, I have had my blood checked every 3 months.)

I am grateful to have found a doctor who supported my desire to not stay on medication but to really get a handle on my health a more natural way. She has been fantastic and supported me every step of the way with her knowledge and allowing me to try alternatives to the typical medical routines.

This book (<=this is an Amazon link to the book, but it is not an affiliate link) has been extremely helpful as I established a routine fasting schedule. And helped me understand my obesity, my diabetes and how fasting could help. And frankly, it hasn’t been hard at all.

I am not a medical professional, and like I said, I have been under a doctor’s care regularly for the past year. But if you are dealing with diabetes or other related issues, check this book out and have a conversation with your own doctor.

How Did You Pay

Now I know you are going to ask about the money…

- We had Medicaid for a year so the bulk of my care and prescriptions were covered under that with no out of pocket expenses except for occasion vitamins (I was low on D and needed a probiotic.)

- During my visit in the spring, I told my doctor that my insurance was ending. (I didn’t have a plan in place at that time for future insurance.) She recommended a prescription plan: GoodRX. It has been amazing at savings for my medication. Although I am off all but one prescription now. I cover prescriptions in our grocery money which is why there is no line item for it. In a given month they run from $3.50 t0 $20 so really negligible.

- She also let me cut down on my visits from quarterly to every 6 months and got me the self pay price of my blood draws so I could save up for them.

We have not been to the doctor since that visit. But do now have a group plan that I was able to purchase when I joined a professional affiliation for my virtual assistant business. It’s more of an emergency plan, but that works for us. But it does cover a annual well visit for myself and Princess.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

This is awesome, Hope! I love Dr. Fung and read his blog weekly! I do a 16:8 fasting protocol Monday-Friday and it helps with sleep and inflammation so much. I used to have some pain in my feet and legs from running injuries and I credit cyclical keto and IF (intermittent fasting) with completely clearing that up and getting me off medication. I was plagued for years – I took steroids and wore special shoes. Not anymore! I dropped Keto in the last few months and I’m planning to start it again as I feel better on it for endurance sports. Not to mention after the adjustment period was over (about 2.5 weeks for me), I began sleeping like a log. I have had sleep trouble my whole life!

Congrats on the lifestyle change!

That makes sense but you have to understand you might end up with a big hospital bill. I would never be without health insurance for myself or the family- a friend of mine has a grandson who took the gamble and had an $$ emergency appendectomy and no, the hospital did not write it off.

You are right, that’s why I invested in this more of an emergency plan vs day to day medical stuff. We rarely go to the doctor…so I felt this was a good compromise financially and a good fit for our needs.

Just be careful Hope. I was diagnosed with breast cancer at 48 and no family history. Just 1 round of a chemo drug that helps it from returning was $14,000 every three weeks. Unfortunately it came back six years ago and went for a double mastectomy, chemo, and another round of one yr. of chemo to keep it away. You just never know what can happen, look at your son.

That is my story, too, Cheryl, except I went 15 years between breast cancer occurrences. One of my surgeries cost $140,000. We are grateful for insurance.

Hope, are you on one of those Christian health plans that is called Samaritan Health or something like that? I’m not sure if they can be trusted to cover expenses over a certain amount. My understanding is that they like young, healthy applicants, so that is a red flag to me. Their resources may be limited for catastrophic coverage.

No, we are on a group plan through a professional organization. I decided against the medical share plan.

Hope, you only go to the doctor rarely until you don’t. I’ve been paying for medical insurance for many years and am never sick- not even a cold- but I won’t take that gamble. My brother just had surgery for diverticulitis that resulted an a long hospital stay since he got sepsis. Does Princess have anything school related since she will be playing volleyball. or is it all on you? It just worries me you especially since you do have diabetes.

Accidents happen and Lord knows having a child in sports heightens those chances. You really have to be smart about this. God forbid something happens to either one of you and you have no insurance. Can you imagine? You recently had 2 wrecks. The Lord was surely watching over you. But had it been bad and you didn’t have insurance. smh. Not good. There are people that end up in bankruptcy because they can’t afford their medical bills.

You are very right. But I have always carried a medical rider on our car insurance.

I’m guessing emergency plan means it comes with a huge deductible. All the more reason to beef up your emergency fund.

It’s not so much a huge deductible as it offers limited coverage for every day medical stuff. Other than the annual visit, everything else comes at a steeper cost (meaning more than a typical co-pay.)

Good for you! I love Dr. Jason Fung! His book The Obesity Code is what got me started on my health journey. Down 60 pounds, off medications, and my husband is down 55 pounds and off SEVEN medications, including two insulins and metformin. His A1C was an astonishing 12.6, but is now 5.5 thanks to keto and intermittent fasting (and sometimes extended fasting). I highly recommend that book, or The Diabetes Code, also by Fung.

Please continue to save for emergencies. As mentioned above, healthcare expenses are… well, expensive!

I just cant wrap my head around foregoing full medical coverage, especially with what just happened with your son. This just seems like a disaster waiting to happen. Hope, I realize you’re looking for places to cut expenses, but medical insurance is not one of them. This could be catastrophic

Hope, huge congratulations on getting your diabetes under control! That is a really big deal.

At the same time, you really really need better insurance coverage for you and Princess, at least (I am hoping Gymnast is covered through his father, Sea Cadet through Americorp…and History Buff…? All of you need coverage. All kinds of things can happen and in the blink of an eye you are in a disaster situation. A broken ankle…apendecitis…anything. And as yet another cancer survivor, please believe me when I say you would be bankrupt in short order.

I also hope that you are keeping up with mammograms and Pap smears. These should not be so expensive.

Please please look into getting insurance through the Marketplace when enrollment opens in December.

Hope, did you take down the post about not joining a gym and why?

I just rescheduled it since Elizabeth’s post was published 10 minutes later. It will go back up today.