What is the sharing economy? It’s definitely a buzzword that you may have seen tossed around over these past few years. In a nutshell, the sharing economy can be described as a peer-to-peer based system of providing or sharing access to goods and services that is facilitated by a community based online platform. Over the past decade, the rise of the smartphone has accelerated the growth of the sharing economy by providing everybody with direct access to goods and services in the hands of ordinary people. Utilizing the sharing economy to your benefit can reduce the costs associated with daily life or travel and leave you with more money to pay down debt in your pursuit of debt-free living.

Taxi Transportation

One of the most prominent examples of the sharing economy are the unparalleled success of Uber and Lyft. In case you’ve been living under a rock for the past few years, Uber and Lyft are smartphone applications that allow users to hail a ride from their smartphones. Instead of hailing a ride from a traditional cab or car service, passengers are actually being connected with regular drivers who are using their own personal vehicles for transport. The flexibility of this system works well for both parties. It allows drivers to utilize their personal assets in a way that can generate spare income in their own free time (driver’s are not required to log a minimum amount of hours or to drive at specific times). Additionally, it has driven the rates for transportation way down when compared to taxi services. A big part of this rate reduction is because Uber and Lyft operate outside of the burdensome, crushing, and overreaching government regulation that has always suppressed private industry.

Hotels

Many frugal consumers are now turning to another sharing economy platform, Airbnb, in order to access affordable accommodations when they’re on the road. Airbnb is a smartphone app and website that connects hosts (homeowners) with guests. It allows homeowners to rent out a spare room or their entire home to travelers on a nightly basis. The rates found on Airbnb are often far less than those offered by traditional hotel chains. Once again, the big factor behind these low rates is because they are operating outside of the crushing government regulation that makes running a hotel so incredibly expensive. Homeowners are simply able to rent out a room when it works best for them, on their terms, and at the pricing that covers their costs with a little extra for their troubles.

Lending

Lending is another space that hasn’t been immune to the expansion of the sharing economy. Up and coming peer-to-peer lenders such as USA Express Loans, who offer $255 payday loans online in California, and Lending Club, who offer peer-to-peer loans up to $35,000 have all embraced the concept of the sharing economy to the benefit of both investors and borrowers. Investors on these platforms who fund loans aren’t big banks or hedge funds. They’re just people like you and I who have some spare cash lying around in their savings and wish to generate a larger return on investment (ROI). They’re able to choose from a list of borrowers who are in need of a payday loan or a cash advance, and fund those loans directly without ever involving a large banking institution.

Saving More

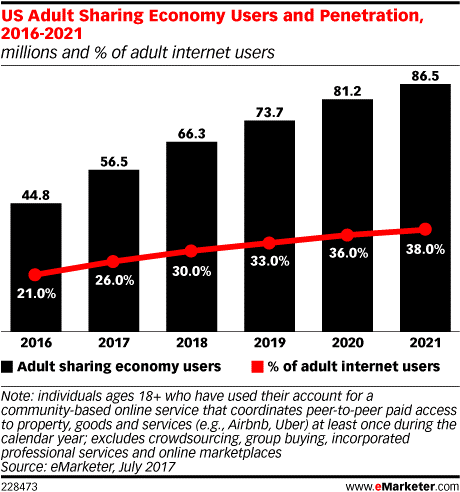

In the end, the sharing economy can enable you to obtain the same goods and services at a much lower price than offered by traditional companies. The categories discussed above only represent small portions of the sharing economy at this time. Not only that, but the industry is growing. It seems like a new company is on the horizon each and every day. We encourage savvy savers to use the sharing economy to their benefit on both sides of the coin; renting out a spare room in their home in order to generate extra income, or using ridesharing applications instead of a traditional taxi service in order to get from point A to point B when you’re out on the town. Every penny counts when saving money and paying down debt. The sharing economy certainly provides many opportunities to save and make money!

So, what do you think ?