by Hope

My daughter and I had a heart to heart this evening about dual enrollment, high school graduation and the looming milestones approaching…drivers license, college or technical school after high school. And that brought up a long term dream of mine, to build a home.

And her statement was that in all these years that I have spoken of my dream, she always thought she would live there, in my dream home. And the reality is, that won’t happen. Building a home isn’t even on the board right now.

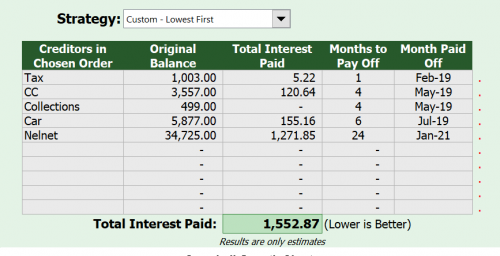

But it did get me thinking about the future. And using a Dave Ramsey based spreadsheet full of formulas based on the snowball method, I decided to look at when my debt free date might be. Using my December debt numbers, an estimated $2,000 month debt payment and the priorities I listed earlier this month, this is when my debts will be paid off. (My current monthly minimum payment is $806 including $100 per month towards the student loans.)

Guys, I could be debt free in exactly 2 years. Completely and utterly debt free. And how perfect would that timing be. Princess is set to graduate in May, 2021. And being debt free, I would be in a much better place to help her with the next phase of her life (and myself, of course.)

This is very motivational. And really gives me a concrete goal to strive towards. It’s no longer a pie in the sky.

My ultimate goal is now to be debt free by 2021! What a great way to start this coming year! What are your financial goals for this year?

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

Hope, you’ve said this exact same thing for 4-5 years now. “Guys! If I pay these debts, they’ll be gone!” But then you acrue more debt, don’t account for interest and fees, and allow your circumstances and daily costs to change for the worse.

Unless you’re genuinely willing to think and act differently (like moving that extra car money over to the credit card, budgeting for simple an expected things like insulin and lunch money), these debts have absolutely no chance of being paid off in 2 years. I’d be willing to bet they won’t be cut in half in 2 years given your methods.

I’m sorry you don’t see the progress I have made, Laura. I certainly appreciate all the advice I am given in and you are right, I do weigh it based on my life and personal circumstances.

But in reality I don’t need to budget insulin (not sure where you would get that I need too.) And I haven’t voluntarily taken on any new debt in quite some time.

OMG you do have a tough skin. May be we all should be like you. Wonder what your commenters are thinking. I have read the comments to your last post and I thought they were a little too much. However, I see you pay no attention to the comments you do not like to see.

It’s good that you are motivated however,$1000 to your debt is much more realistic for two reasons…..1) That is largely the amount you have put towards debt since you started a new budget. 2) You tend to want to do things like travel to your parents, pay for camp or sporting event programs and I really don’t see this aspect of your personality changing. I would much rather see you consistently and realistically pledge $1000 with you choosing to put any excess wherever(including to debt if you wish) then see you pledge $2000 and 2 months in see you say it is not going to happen because you are traveling to Texas for Easter and Spring Break or because you are back to covering volleyball camp. Your budget needs to reflect your reality and priorities.

I would have to agree with Cwaltz on this. I would like to see you stick to a budget (at this point any kind of budget) and see some progress made on your debt. My children are all “adults” now and when they were younger they understood that our money went into our debt repayment and into the household bills before any additional was put towards “fun”. We could not have any “fun” with spending for trips, extra sports, clothes, traveling until our debt was a bit more under control. My oldest is 23 and she has a good thought process regarding debt. My special needs son is aware that he can not spend more than what he has and he has to save part of his income each month. My daughter is 21 and she is learning about how to manage money appropriately. I feel that these are “things” that you could teach the “Adult” kids in order to guide them to success in life and not follow the path that has been laid out for them especially since your daughter stated that “And her statement was that in all these years that I have spoken of my dream, she always thought she would live there, in my dream home”.

A dream home is a nice thought and a goal that can be worked on. I wonder what you are willing to do to get there and how your kids can help contribute to the goal of a “dream home”. I am using Dave Ramsey’s steps and managed to pay all of my husband’s and my debt with the exception of my student loan and mortgage. It took years of discipline and hard work. I did this while being a student in a master’s program, working three jobs, and providing for my family of five.

Hi Deborah,

I’ve been reading more on Dave Ramsey’s baby steps recently, even joined a FB group for single moms on the subject. The dream home was just part of the conversation, not really a question at this time.

With Sea Cadet preparing to spread his wings upon his graduation in August and History Buff beginning his first year of college. And of course, Princess finishing high school and starting college (2 1/2 more years of high school will put 2 years of college under her belt.) We are laser focused on getting them all through school with no debt by them working and paying some of their own bills. We sit down and do quarterly budgets together. And me getting out of debt.

The dream home…well, it’s just a dream. And it’s in the past.

I actually thought this as I pushed publish that day. And you are right having an extra $194 per month to put towards debt is much more realistic than having an extra $1,194 per month to put towards debt. I will have to re-run the numbers and see where that puts me.

On the flip side, over the last quarter of 2018, I did made that extra $1000 each month – saved $1,700 for the Texas trip, paid $2,500 towards the tax debt and put an extra $1,000 in my EF. So while it may be a stretch some months. It is not necessarily out of the question, especially with my continued work growth and the expansion plans I have this year for my business.

I do plan to stick to the monthly budget I posted last month. That is my budget. It’s the extra income that I hope to make that would make this timeframe happen…which I know as an entrepreneur can change with the drop of a hat. But thank you for your feedback. I am going to run the numbers again with the $1,000 monthly debt payment to see where that takes me and I will publish it.

I am sure I left a message here saying Hope has a thick skin since she chooses not to hear her commenters. Let’s see if this comment will be posted.

I do hear them, read all of them. But you are right, after 4 years. I have learned to not take everything personally. And I certainly know there is alot to my life that 1) is not said here and 2) is unconventional by most people’s standards. And I’m okay with that. But the bottom line is, I am making strides to being debt free. I am feeling very hopeful and greatly anticipating the day that this will be a reality.

I am so confused. Where is $2000 a month for debt repayments coming from? Have you always had $2000 for repayments? If so, what have you been doing with it til now? Your last budget had minimums of $706. I don’t understand.

First, the $706 went to $806 with the addition of the $100 towards the student loans.

Second, if you look at the last quarter of 2018, I saved $1700 for the Texas trip, paid $2500 extra towards the tax debt and put another $1000 towards my EF.

The “extra” is when business goes well. And over the last 9 months it has steadily grown and I have expansion plans for this year and continued work. So the extra $1,194 towards debt (over and above the budgeted $806) would come from additional work/income that I hope to have. Of course, it’s not guaranteed, but looking at the last quarter, it is possible.

Does this answer your question?

Happy New Year! to the BAD family

Thank you, T’Pol, same to you!

Good luck, I really hope you can be debt free in a couple of years.

Even if it seems confusing to long term readers, I do hope the numbers add up for you and it all can be paid off. Everyone is just so negative here, like damn!

Thank you, jj, me too!!