by Hope

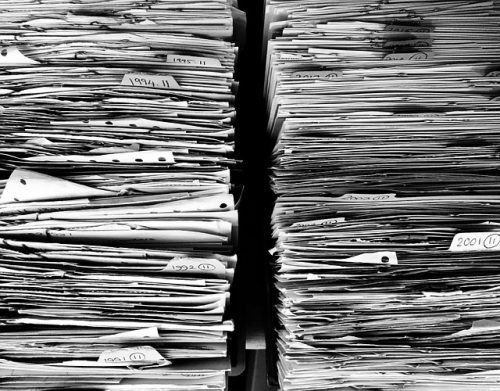

The living room and dining room table is where clutter turns into shame. Paper work, stacks of mail “to sort later,” and sentimental piles that slowly swallow the sofa, the dining table, the tv stands, and so on and so forth.

We’ve gotten that we clear off the table bi-weekly when the family comes for dinner. But we just pick the piles up, and pile them on a bed in an extra bedroom. I told dad this week as we were doing that yet again. That I don’t know what I agree to this. Because once I return from my wedding trip to Georgia, I’m going to have to tackle that room. It will be piled high with randomness and the closet is already full of boxes of paperwork, sentimental items, and things they never unpacked when they moved here over a decade ago.

The Decision Framework

“Honor the story, protect the space.” The goal is to keep visible, curated history-without losing the room to cardboard time capsules.

Two Power Stations

This is my plan for October, leading up to the holidays and the kids coming. Because we will need all the extra beds/bedrooms for their visits

Incoming Paper:

Three files by the printer in the back room: “To Pay,” “To File,” “To Call.”

One small shredder.

Weekly 15-minute “Bills & Banter” appointment on the calendar.

Dad wants me to take over the bill pay and financial tracking. But for now, I’m just trying to get it organized and be familiar. And I’ve got to file several years of back taxes. (My sister takes care of my mom’s accounts, etc.)

Memory Lane:

I’m slowly going room by room and sorting through the “stuff”. My mom has been incapacitated for the bulk of the last 5 years (diagnosed 8 years ago) so the house has long been neglected. I mentioned earlier that all items I question keeping first go through my dad, then my siblings. It’s working for us.

My mom has always kept a beautiful home. I have no idea how she did it with all 5 of us kids. But she also became a thrifter in the last couple of decades. It’s all curated well, but us kids don’t have a lot of sentimental value placed on many of the decor or knick knacks collecting dust.

Wrapping Paper & Bags Limits

I discovered two LARGE boxes of just gift wrapping supplies. And then a hutch full of holiday tins. I’ve put them in away for now. But made it clear to dad that we are going to use that stuff for Christmas this year and do a major purge at that time.

I’m sure as I continue on this with segment of the purge, there will be more, but the mail and paperwork are the bane of my existence right now. Thankfully, I enjoy being busy. So when I’m not working, I’m sorting, purging, cleaning, and organizing. Keeping an continual list of to dos as I discover them.

Money Impact

Bills surface and get paid on time.

No more buying gift bags or wrapping paper.

Clear surfaces by putting things in their place. And if they don’t have a place, do we really need to keep this?

30-Minute Reset

Sweep every flat surface into three piles: paper, not-paper, sentimental.

Paper goes straight to the station: pay/file/call.

Not-paper either returns to its home or gets reviewed for its merit.

The Livability Test

THIS! I saw this in an article and keep it on repeat for dad as we discuss upcoming family gatherings and maintaining the home.

Can we sit on every seat without moving a pile?

Can we vacuum without clearing the floor first?

Maintenance Schedule

I’ve built myself a cleaning schedule that I am working hard to stick too. After sweeping, scrubbing, and mopping the kitchen took me 6 hours the first time because there was so much build up, I said never again. And so did my back.

Weekly 15-minute “Room Reset” (set a timer, cue a favorite song). I have to do this when dad is away. He doesn’t like my music 🙂

Weekly mini-audit on what’s coming up the next week. And what can I do to support him. We are currently sharing my car while his is in the shop, so this has become even more important although outside of church and a meal out every two weeks, I rarely leave the house.

What one limit would make the biggest difference where you live?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.