by Hope

Well, my goal of Two No Spend Months kind of flopped when my heat went out, my glasses broke, and so forth and so on. I didn’t exactly no spend. But I didn’t spend anything I didn’t HAVE TO!

Our Neighbors

I don’t know if I have written much about my neighbors here. When we first moved into our house, 4 of the 8 houses closest to us were rentals. Over the last, almost 7 years, there have been some changes. Now only 3 of them are rentals. But most of our neighbors are pretty up there in age. In fact, of the 5 non-rentals, 4 of them have been there longer than us. And we LOVE our long term neighbors and some of our newer neighbors as well.

However, the drawback to everyone having been here forever is that many of our neighbors are quite old. In fact, in the days between starting this post and now finishing it, one of them has died. His daughter called me today. (He’s the one who had run over my mailbox. I shared that, right?!?)

Anyways, as his health worsened we did what we could to help. We grocery shopped for him, answered his calls for help on whatever. I even got to climb through his bedroom window one day to let the EMTs in when they couldn’t find a house key. For the last couple of years, Gymnast worked on his yard. And we spent hours listening to him reminisce about the “olden” days up in Illinois where he was from and raised his 5 children.

Unexpected Help

All that is to give some back story on how our cupboards and freezer got re-stocked. When he was admitted to the hospital for the last time and told that the end was imminent (heart issues,) he knew he would never come home again.

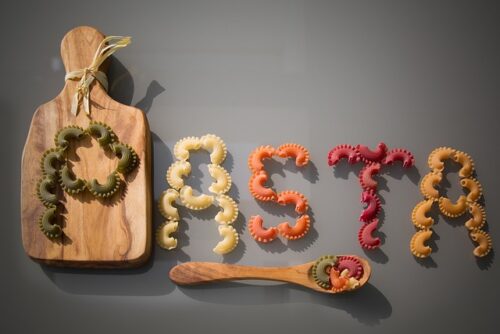

And he graciously had his grand-daughter clean out his food and give it to us and another neighbor. We received a freezer full of food – bread, meat, frozen meals, along with eggs, bread, and a few other canned items. Oh, and I failed to mention that he was Italian so this food is really good. I didn’t have to spend a dime on food for the previous two months.

I’m also confident that with a small re-stock in the next week or so, we can go another two No Spend months.

So this post is a gratitude post to our neighbor Mark. May he rest in peace.