by Beks

We have three streams of income for our household. 1) My husband’s construction company. We ramped this down to nearly nothing last year. He takes very occasional small jobs. 2) My husband’s night job working from home for my dad’s company. He’s been doing admin work there for a few years. He’s ramped this up since the fall, most recently working 20-30 hours a week. 3) My full-time job.

My paycheck covers all our basic bills. Everything he earns we use to pay non-reoccurring expenses like car repairs, vet bills, etc.

I felt safe with this set up since we never put all our eggs in one basket. No, my husband wasn’t earning a full-time income, but his part-time work made it so we could breathe. In the last month, everything changed. The construction jobs completely disappeared. We had a flurry for a couple weeks and then nothing at all. Then he was laid off at my dad’s company.

Our three-legged income is down to a single leg.

Then my work announced pay cuts. Far better than a furlough or a layoff, but still a hit to our income. We don’t have a percentage yet but they’ve announced it will be no less than 10%. They’ve also announced we should expect layoffs in the summer.

My husband was able to file for unemployment from the job he had at my dad’s company. Some have recommended we apply for the Payroll Protection Program for my husband’s company instead but the income has been so low since the fall we wouldn’t likely qualify. It took three tries to file for unemployment since the website kept crashing but we eventually got through.

I know some folks like to pay family cash ‘under the table’ but my dad raised me to always be honest with the IRS. My husband has been an official employee paying taxes for years. In times like these when unemployment is essential, I’m grateful for my dad’s wisdom. For all you folks out there who pay people under the table, it will eventually burn you.

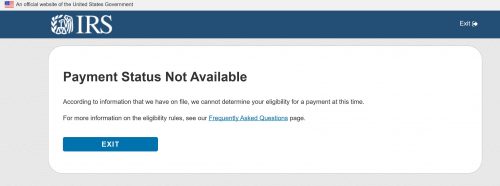

Remember how I shared that 2018 was a banner year for us and we were slammed with taxes? Whelp, it’s burning us for a second time. We earned just over $150K in 2018 so we won’t be receiving the full stimulus payment. ‘But it’s based on 2019 taxes!’ Yes, I hear you yelling that. We paper filed our 2019 taxes (which are WELL BELOW the $150K limit) in early March. Thanks to the pandemic, they haven’t been processed so they are using our 2018 numbers. Yes, I know we will eventually get the rest of the stimulus money next year when we file our taxes but that doesn’t help us right now. Even worse, we are one of the millions of folks who get the ‘Payment Status Unavailable’ response.

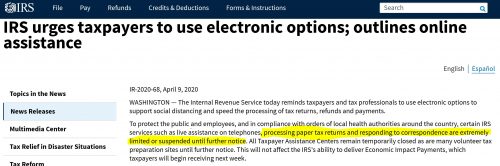

And the awesomeness just keeps rolling for us. We are expecting a $6K refund. Per the IRS…

*sigh*

We had to register the kids for summer camp when registration opened and I was playing a shell game with that payment assuming my refund was coming soon. We decided not to use the emergency fund (learned our lesson on that one!) and instead, emptied some ‘sinking fund’ categories like our phone replacement and our clothing fund. Now I’m praying like crazy that we don’t break our phones and the kids can hold off on shoes!

Despite my long rant, things aren’t that bad. I’m grateful not have debt at this time. I don’t worry about a credit card bill, student loan, or a car payment. We also still have our emergency fund sitting untouched. We’ll come out of this just fine. We’ll be a little scraped. A little bruised. But far better than we would have been a few short years ago.

Beks is a full-time government employee who enjoys blogging late into the night after her four kids have gone to sleep. She’s been married to Chris, her college sweetheart, for 15 years. In 2017, after 3 long years working the Dave Ramsey Baby Steps, they paid off more than $70K and became debt free. When she’s not working or blogging, she’s exploring the great outdoors.