by Hope

Phew, it seems like forever since I’ve felt good about giving a debt update. But I am over the moon as I write this!

This girl’s only debt, only debt…are my student loans. And I did make an extra payment to them, along with my now regularly required monthly payment of $307. For those that are new, my student loans have been in deferment for a very long time. But no more!

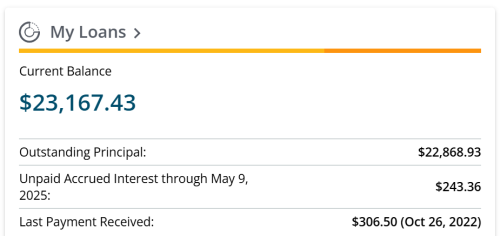

Prior to this month’s payment, this is where my student loans stood.

You can see, it has been a LONG time since I made a payment toward them.

But here we are today…

| Debt Description | October, 2023 Total | Interest Rate | Minimum Payment | Current Total | Payoff Date (Est) |

|---|---|---|---|---|---|

| Student Loans | $22,121 | 2.875% | $307 | $21,811 | |

| CC - Apple** | $500 | Paid off every month | $0 | ||

| CC - Frontier | $3,857 | 29.99% | $0 | $0 | May, 2025 |

| Dad - New Furnace | $2,600 | 0% | $0 | $0 | May, 2025 |

| CC - USAA | $5,000 | 19.15% | $0 | $0 | May, 2025 |

| CC - Sam's Club | $0 | May, 2025 (again) | |||

| CC - Amazon | $0 | May, 2025 (again) | |||

| CC - Southwest | $0 | May, 2025 | |||

| Painter | $0 | May, 2025 | |||

| CC - AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 - Closed |

| CC - Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Personal Loan #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Personal Loan #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC - Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 - Closed |

| CC - Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Total | $44,206 | $265 | $32,131 |

Getting Acclimated & Making Plans

As of yesterday, I’ve been at my parent’s in Texas for one week. Dad and I are slowly adjusting to a new normal and getting into a routine. And I’m still feeling out the area and keeping an eye out for things to get involved in.

My number one priority is to be available to help care for my mom. What that looks like now is giving Dad the freedom to get out and about a bit without being worried about inconveniencing anyone. We’ve set two days a week that he knows that I will be here, ie not make any plans that would take me away from the house, and he doesn’t have to “ask” for coverage. He’s still struggling with that. (I don’t leave the house often anyways, but this regular schedule gives him more freedom than he’s had in years as mom’s constant companion and primary caregiver. My siblings have been fantastic about helping. But dad struggles with asking and feeling like a burden. I’m hoping this alleviates that weight on his shoulders a bit.)

On the flip side, I’m looking for ways to build community. A type of self care that I need. I visited a new church with Gymnast on Sunday. And I’ve reach out a couple of places to check on volunteer opportunities. Now I’m thinking of creating a flyer to print and drop off at local businesses to advertise my services.

I actually went to a chiropractor and in discussions about what I do, he hired me to help with his website and marketing. I just need to get more bold with putting it out there.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.