by Hope

I am enjoying all the end of year recaps the various platforms do. From social media to financial, they seem to have a spin on it. I thought I’d share with you the numbers from my weekly investment platform: Stash.

I’ve now had an active investment account here for just over two and a half years. I received $75 as an incentive to set up the account and get started. And I started really, really small…investing $5 per week.

And then I needed the money so I took most of it out. I’m ashamed to say that I’ve dipped into this account twice over the 2 1/2 years that I’ve had it. But never completely emptied the account. And as work came in, I began investing again. Staying small at $5 per week.

Then I had some time on my hands and I begin looking around the app. I diversified my investments based on category. I played all their “games” to earn investments. And I started learning more and more. As I did that, I began investing more and in a couple of different accounts.

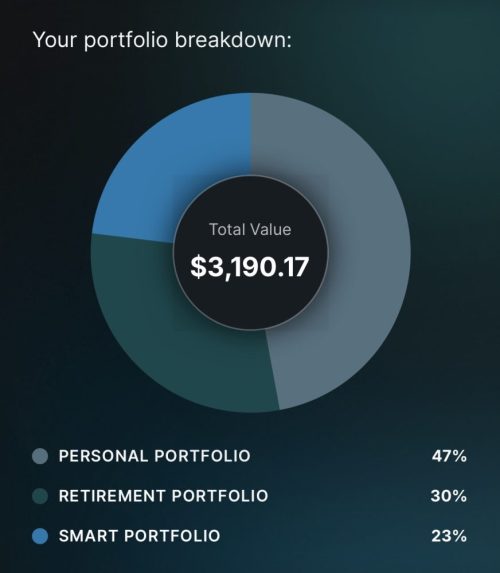

Now I have a ROTH account, a personal account where I manage where my money is invested, and a smart portfolio where they manage my investments. You can see the breakdown in the first screenshot above.

Now I invest $100 a week with Stash. And I’ve been really consistent with that over the last 11 months. I know it’s not a lot. But it’s no longer my only investment platform. I continue to study and learn. And I’m proud of that.

I really like this platform. And the links in the post are referral links, like THIS ONE. If you open an account and invest just $5, we will both receive a $30 deposit to our accounts. I am definitely not an expert. But I am learning, and this platform has been great for that.

If you are like me, and want to dip your toes in the “investment” waters, I highly recommend STASH. It’s been easy, educational, and thus far, I’m still ahead. And from this, I’ve gotten bolder and now have two other investment accounts that are a bit more advanced…but I am definitely still a beginner.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

So, what do you think ?