by Hope

I’m very proud of myself. Here’s why…

Debt

| Debt Description | October, 2023 Total | Interest Rate | Minimum Payment | Current Total | Payoff Date (Est) |

|---|---|---|---|---|---|

| Student Loans | $22,121 | 2.875% | $307 | $19,036 | |

| CC - Apple** | $500 | $0 | May, 2025 | ||

| CC - Frontier | $3,857 | 29.99% | $0 | $0 | May, 2025 - Closed |

| Dad - New Furnace | $2,600 | 0% | $0 | $0 | May, 2025 |

| CC - USAA | $5,000 | 19.15% | $0 | $0 | May, 2025 |

| CC - Sam's Club | $0 | May, 2025 (again) | |||

| CC - Amazon | $0 | May, 2025 (again) - Closed | |||

| CC - Southwest | $0 | May, 2025 | |||

| Painter | $0 | May, 2025 | |||

| CC - AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 - Closed |

| CC - Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Personal Loan #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Personal Loan #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC - Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 - Closed |

| CC - Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Total | $44,206 | $307 | $19,036 |

I paid $1,925 to debt in July. (June’s debt update.) For the first time in 3 decades, I have under $20K in debt, no credit card debt, rather no other debt. My car is paid off and in good shape and I am in a great place mentally.

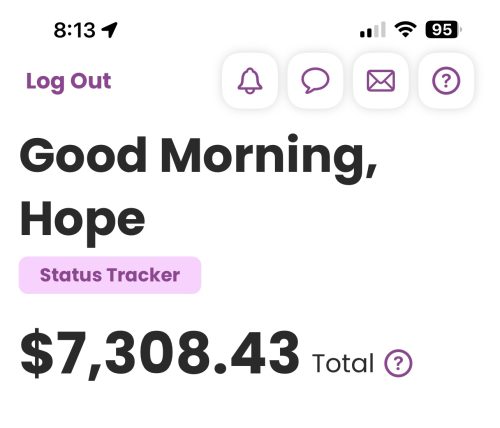

There is a light at the end of this very long tunnel. On top of that, I have money in the bank!

Savings

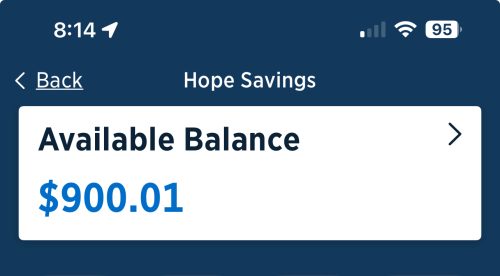

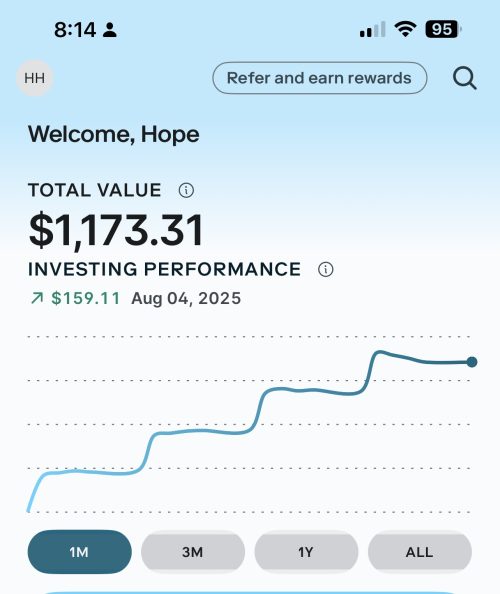

I have more money in savings than I’ve had in DECADES. And not only that, but I’m not touching it. I have no immediate plans for it (you’ve seen my Budget and the Buckets I’m using in Ally). I have literally not touched my Ally account since I initially opened it with $5,000 from the house sell.

I have WEEKLY automated deposits going to both my Ally account and my investments account. (For the record, these screenshots are from the end of July.)

Summary

Listen, I know it’s not where I need to be at my age. I get that. Truly.

But I can’t go back. I can go forward though, and I am. And I am proud of myself.

My attention is split…debt and savings. Maybe not the most efficient way to do it. But I am doing it. Debt is dropping steadily, savings is growing rapidly.

I literally went from $0 in savings, living on a shoestring to having close to $10K in savings accounts in just over 2 months. And as my income grows, my savings and debt payoff goes more quickly.

This Month

Now this month, I will spend some money. Princess and I are throwing Beauty a bridal shower. I budgeted $1,500 – most coming from my monthly “allowance” that I haven’t really touched. I’ll share the details on how that goes later as I’m still trying to figure everything out. As of today, I’ve spent the following:

- $33 for invitations. I designed them on Canva and then had them printed there. I used stamps I had so not counting that expense.

- $50 to hold the event space. I will pay another $200 before the event. The event space includes tables, chairs, table cloths, and serving ware.

- $11 for my flight to and from ATL – yes, more points.

- $196 for table decorations (flowers) and supplies for an activity.

I know I’m going to supply some food. And another game or too – thinking of the toilet paper to make wedding dresses. I’m honestly just feeling my way as I’ve never had a bridal shower or attended one. But it will be fun to experience this with my girls and celebrate Beauty!

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

You’re disclosing assets of approximately $9,500.

Concurrently, you still have $19,000 of student debt.

And you used to have $51K 3 months ago, of which you accounted for spending $34K in your debt series and now another $1925 towards student loans. Adding your current savings leaves a deficit of $5,500 (51-34-1.9-9.5K) of further spending above your means in the last 3 months. (as part of the $34K was spending above your means).

Personally I don’t think you can afford to spend $1500 on the bridal shower. It’s 15% of all the money you have in the world, for one party. At the rate you have been spending money you risk needing to go back into debt to fund it.

I get that it’s a once in a lifetime thing, child’s milestone etc, and there would be regrets if not done, but if that expense is so important to you, you have to cut back elsewhere, and you haven’t been doing that. Remember you’ll also have more costs for the actual wedding.

Hope, You will never learn. YOU CANNOT AFFORD to throw anyone a shower. Show up, make a homemade gift, or give the gift of time, and that is it. You are literally never going to break your cycle. $1500 towards you student loan debt or retirement invested over a decade is double that in interest saved or potential growth.

I think given your situation, $1,500 for a bridal shower seems extravagant. Do you have to use a designated caterer at the facility you’re renting? You say you’re using your monthly allowance, but sheesh that’s an amount equal to about 15% of what you have in savings, for a few hour event. I know how defensive you get when it comes to spending money on your kids, but you are still in a precarious financial position. Please re-think the budget for this event.

I won’t have a caterer. Just going to pick up finger foods. Princess may make a charcueterie board. We are waiting on a head count. We gave everyone through the 10th to RSVP.

Also, don’t know that full amount will be spent. Don’t expect it will at this point. But that’s what I have saved from my monthly spending amount.

I believe there are still several thousand dollars of house proceeds that were spent and not explained. It’s true you can’t go back and change what you did, but you won’t have a better future unless you move forward with full transparency.

I don’t know, Hope, This post feels like you are creating how you want to spin things rather than building a real plan on the full truth. Maybe to yourself as much as to the readers. For example, the automatic transfers to savings. That’s generally a good idea, sure. But you can’t seem to put together an organized view into your personal income, so no one can know if your income will meet your expenses. If not, then automatic transfers to savings do not actually achieve anything for you. Most of these positive things you want to claim in this post ring false in this way, due to lack of transparency into their necessary underpinnings.

You are right. I haven’t completed that series. Life got busy. I haven’t forgotten.

You are right in that putting together a view of my income has been hard since it literally changes week to week. From my weekly paying clients, I receive that money on Thursdays so I always know if there’s enough for the weekly transfers to savings and investments. Knock on wood, I’ve not received less than that weekly transfer amount in over 3 months now on a weekly basis. But I also know from my history that could change any week.

And no, I have no idea how to clearly communicate this.

One actionable change I would make here is that if you aren’t at the stage with self-employment where you can work with a reliable income figure (whether you use a low month or a hills/valleys average), then you need to show you paid expenses before you transfer to savings for budgeting purposes.

You can’t skip past answering “will my income cover my expenses” in order to get a real benefit from transferring to savings and investments. You haven’t shown lately that you can answer that question, therefore these transfers will become meaningless when you end up raiding savings to cover expenses.

Ok, I’m going to ask. What’s the rest of the $1500 for the bridal shower going to be spent on? I’ve never seen a bridal shower cost that much.

Just curious.

To reiterate, I know nothing of bridal showers/weddings. This is what I’ve saved up from my monthly spending money.

I don’t think it will cost that much now that I’m in full planning mode.

I now I’ve got to get food, but waiting on a solid head count. And a few other activity items and “prizes” for winners.

But what ever is left over will feed into the next pot which will be the wedding trip which is Sept/Oct when I’m driving there and will stay a couple of weeks.

$1,500 is WAY too much to spend on a shower. You are going to quickly go through your savings at this rate. Have it at someone’s house or a public park. Get deli trays from the grocery store. Keep the games to a minimum, I don’t know anyone who enjoys those anyway. Are any of her friends chipping in?

There is always going to be a special occasion, you can’t keep spending like this for all of them.

None of this is coming from savings. I have $400 a month budgeted as “allowance” – I’ve been hoarding that for this event.

As for the food, it will be finger foods from somewhere local. I just don’t have a head count yet.

The $1500 is the amount I’ve saved from my “spending” money, not touching any other monies.

I had no idea what to expect so I thought it was best to over budget than under budget.

I think your approach to this event is a great example of why some readers are frustrated. There is some nuance here, but instead of budgeting $1,500 and saying “I have no idea how much this will cost.” We would like there to be a budget beforehand, and see that it’s reflective of your situation. If you said “I will spend $500 max on this event.” And then showed us some numbers, that may help. You’re basing a lot on the headcount, but in your case, I’d rather see you base it on what you can afford. If you have $300 for food and drinks, then you adjust what you serve if you have 30 people vs 50 people. Bridal showers can be a jazzed up Costco sheet cake and some punch, and that’s just fine. I’d much rather have that than know that someone throwing it was spending money that keeps them in a tough spot. You have negative net worth and are in your 50s. Unfortunately, you’ve got to make these choices every day if that’s ever going to change.

Kudos for starting to save money each month but I also think you’re fooling yourself a bit. You still owe more than you have saved and you’re still in debt. You got lucky with your house sale and had a little chunk of money, but I should scare you how quickly you’re spending it. You have no budget for Beauty’s shower, you plan to just pay whatever it ends up costing. I think that provides a lot of insight into what you feel a budget is. It should be the other way around, you’re willing to pay $x for each part of the shower and work within that budget. Instead, you just choose some random number out of thin air and hope that’s how much it costs.

Actually, no. I have saved every month towards this. $1,500 is the amount I have saved. That’s what I have to spend without touching savings, etc.

Of that amount, I detailed what has been spent. And that I know I still will have to pay for food and a few other items for activities.

This $1,500 is not part of the savings I shared the other day. That’s all in separate accounts that I don’t touch.

I think youre missing my point because you automatically get defensive. You are still in debt because you owe more to your student loans than you have saved. Separately from that, you are approaching Beauty’s shower from the opposite way that you should. Katie above said it perfectly – instead of saying, I don’t know how much this will cost me until I have a final headcount, you need to say I’m only spending xyz no matter how many people are coming. If 100 people come, then Ill spend $15/person and if 50 come, then it will be $30/person. But unless you’re having a sit down meal at a restaurant, there is no reason it should cost this much. Make some cookies and cupcakes, have punch, decorate with balloons and she will love it just the same.