by Hope

Ran an ad campaign for a “on the fence” client recent or rather, still.

I created the assets (graphics), copy, and determined the strategy. And I ran it. Starting with a $250/day budget. (Client pays add spend.)

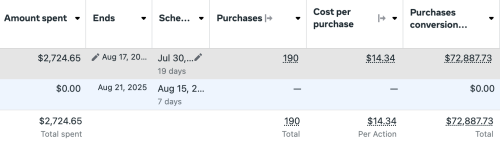

To date, I’ve made them just over $72K with an ad spend of $2.7K. For a ROAS of nearly $27 for every $1 spent. Not too shabby.

To be honest, it is an easy product to sell, and I know this audience. Very well. So the psychology of the messaging and finding the right audience was easier than most of the campaigns I am charged with.

Today I received a phone call from the CEO of the company. He gave me a bonus – paid out as soon as our phone call was over. And has verbally agreed to an extension of my contract. Or rather a new contract with new deliverables.

It’s been a few years since I received a Bonus for my work. As far as I know, it’s not a common thing in the contractor world.

The Plan

So what am I going to do with it? I knew you would ask. (It’s $1,000 so I should end up with $600-700.)

Outside of taxes, gov fees, the entirety will go to savings. My dad and I have been talking. He’s kind of my accountability partner. And certainly who I bounce my ideas off of. It’s nice to have one of those after decades of doing things alone.

He would like me to get to $10K in my Ally savings account, $1K in my EF (easily accessible account, and then focus solely on paying off my remaining debt.

What do you all think of this plan?

If all goes well this month, I think I might hit those savings goals. Then turn my attention to my debt alone (outside of the auto-transfers to savings and investments totalling $125 per week.)

Thoughts?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

100% on board with the 10k in ally.

Iffy on the debt repayment….you finally paid off all your debts except that pesky student loan (I’m assuming this is still correct? – get rid of anything new)…that student loan interest rate of 2.875% is SOOOO low. I’d honestly keep it for life. (is that 2.875% permanent? if not, get rid of it).

My 2 cents (worth nothing): get to the 10k in ally, then focus on your retirement. at the very least max out an IRA (traditional for the tax breaks), but ideally max out an i401k.