by Hope

There are some moments in life when the air just feels different — like you’re breathing lighter for the first time in what feels like years. Selling my home was one of those moments. It wasn’t just about changing addresses. It was about closing a chapter that had been filled with stress, hustle, and a whole lot of heavy debt. And now, for the first time in a long time, I am stepping into a future that feels full of possibility.

As I sit here reflecting and staring at this huge number in my bank account, I am overwhelmed with gratitude. I’ve just arrived in Texas and am taking some days to unpack, unwind, and settle in. Before anything else, I had one priority: to pay the people who stood by me when I needed help the most.

I ended up with $51,660 from the house sale.

First house proceeds spent

First up was the painter – this man who did incredible work on my home since I purchased it. He has patiently waited for the second half of his payment for the painting done during the sales process until the house proceeds came through. His trust and understanding stayed with me through the entire selling process, and it felt amazing to finally send him what he was owed.

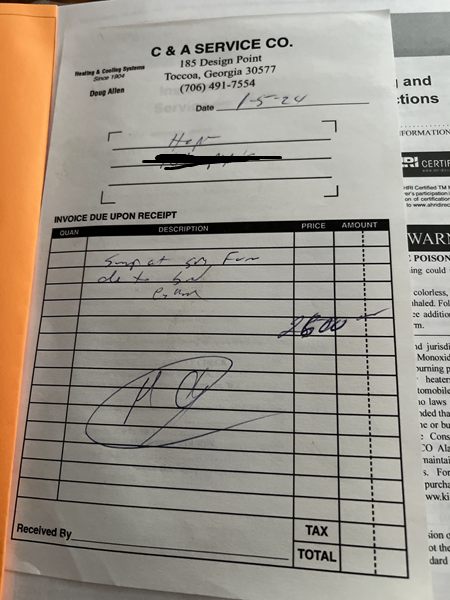

Then, my dad. Where do you even begin thanking someone who quietly steps in with a solution when you’re freezing in your own home? In January 2024, my furnace gave up on life in the middle of winter, and my dad didn’t even hesitate to front the cost for a new one. He’s been patiently waiting almost a year and a half for repayment, never once making me feel rushed or guilty. Writing that check to him was a full-circle moment that left me teary-eyed and full of gratitude. (I actually mailed a thank you card and post-dated check before I left Georgia.)

And finally, the beast: $21,000 in credit card debt. Typing that number still feels surreal. It’s been the kind of mountain that looms in the background of everything I have done – making every grocery run, every birthday gift, every small joy feel a little bit heavier. But not anymore. With the house sale proceeds, that debt is gone. The payments are processing as I write this, and I can’t wait to share more detailed updates in the coming posts.

A new chapter

Right now, I’m standing on the threshold of a brand new chapter. One without the constant, gnawing anxiety of “how will I pay for this?” One where I can breathe easier and plan for a future instead of scrambling to patch up the past.

To everyone who extended grace, patience, and support through this messy, beautiful journey: thank you. I will never take this fresh start for granted.

Here’s to new beginnings and living a life that’s almost completely free from the weight of old debts.

Next, I will be making firm decisions on what to do with the remaining monies from the sale. While I’m not completely debt-free just yet, with only my student loans standing in the path. I can see the finish line ahead. For the first time since I was 21 years old, being completely debt-free feels not just possible, but inevitable.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Hope,

Let me be the first person to tell you congratulations for being completely paid off other than your student loans. That is an insanely huge milestone and you should feel proud of yourself for that. Take time to celebrate (without blowing a ton of cash obviously! But maybe a dinner out with dad isn’t a bad idea!

Next steps: ensure you cannot rack up those credit cards all over again. Cut them up, freeze them, something that will make you think over and over before using them.

2nd: Safety net. I suggest 2 of them, 1 for funds you are allowed to touch for short term loans to yourself…maybe 1 thousand bucks or so here. The 2nd, is your long term emergency fund that you do not touch unless it is a TRUE emergency. Life, death, security. Yours or your kids but these are NEEDS not wants. Suggest 10k here if at all possible.

3rd: Anything left start thinking of planning for the future. Maybe 50/50 in the house fund vs investments? Something like that.

You’ve got this. Congrats again!!!

I am so glad you paid your dad and the painter. Paying off the credit cards will make no difference unless you address why you continue to blow them up no matter your life situation. You really need to close them all but 2 and make the back up one inaccessible except for an emergency. you have approximately $25,000 left. That money should be split between a more cash accessible emergency fund ($10K) and a CD or account you cannot touch for at least 18 months. You should not be accessing a dime of that money for anything at all-not a car, not a payment, not a dinner, not savings for your tiny house. That money should be squirreled away for the future with out it being attaching to any item, simply emergency back up funds. It truly is not a large sum of money in the big scheme of things. It is what should ALWAYS be in your emergency fund. Your day to day, car, travel, gifting, savings, retirement, insurance, etc should all be totally separate. You need to forget this money ever existed. Use the time you are at your parents house with no living expenses to bulk up your day to day accounts and pay on your student loans. I do hope you really take this outcome and use it wisely, unfortunately as a ready for a very long time I have seen this happen so many times (a windfall, a new job or contract, a new living situation, etc) and you wind up back where you started. Enjoy your happy moment and relish in it, and try to remember it when you are tempted to “just ….xyz” and spend it. We do not want to see any posts saying “Here me out…” followed by a bad financial decision! Cheers to the exciting grad and wedding upcoming! Enjoy your family time!

good grief, autocorrect was not my friend! Reader, not ready. Hear, not here!