by Sara S

We just hit a detour on our debt journey sooner than we expected: we’re seriously considering moving. Which kinda makes me want to cry. Or pass out.

We bought our house in 2014, and then in 2016 we bought our business in the next city over. The plan has always been to eventually move by our business. It’s nicer, safer, and the schools are awesome. Plus the commute would be a dream.

We figured a move was years away because we wanted to buy our “forever” home next, and we’re obviously in no shape financially to do that right now. Just a few weeks ago I was still thinking we wouldn’t be moving for a long time.

But recently reality has hit us and we feel now is the time to relocate. It’s not a decision we take lightly. I moved around a lot as a kid (I went to five elementary schools in four states), and I know firsthand how hard even a short-distance move can be on a kid.

This move is in our family’s best interest, though. Our oldest daughter is almost ten years old and in fourth grade. Middle school in this new area starts in sixth grade, and we’d like to give her time to make friends for at least one year in elementary school before we throw her to the wolves.

Could Moving Hurt Our Debt Journey?

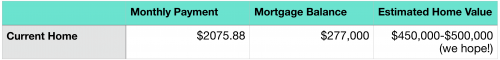

We do worry about the financial impact of this idea. Here’s our current home situation:

We don’t want a higher monthly payment. This new area is more expensive, so we’ll be downsizing or downgrading in one way or another—we’ll have a smaller lot, an older home, and/or less square footage. Real estate here ain’t cheap and lots are tiny. But if it gets our kids settled in good schools in an area we love, it’s worth it to us.

This all makes our 2020 debt journey look less rosy. We’ll definitely be making fewer extra payments on our loans. If our home is valued low, we might have to save up for a better down payment. And for sure there will be the usual moving expenses. We’re not moving cross-country like we have before, but there will still be repairs, fees, and other costs.

Could Moving Help Our Debt Journey?

One thought I’ve had (that my husband hates) is that we owe $292,000 on our student loans. We could sell our home, put all the cash towards our debt, and then rent in the new area until we can buy again.

Pros: We’d cut away a huge chunk of our student loans, and we could pay them off years sooner.

Cons: We’d still be at least $92,000 in debt and very far from buying a home. Rent in the new area is expensive and climbing (even smaller homes can be $2000 a month!). This may keep us from giving our kids the stability we’re shooting for.

I’m meeting with a real estate agent today to figure out what our home is worth, so we’ll be able to make a more informed decision soon. But in the mean time, I’d love to hear what would you do?

Rates on mortgages are so low right now. It’s better to pay down debts with higher interest first and ride the rest on your mortgage. What’s the rate on your student loans, is it higher than the mortgage? I’d use the proceeds to put 20% down on a new house, with maybe like 5% as a starter home emergency/need fund (not a want fund!). Then I’d take the remainder and throw it at the student loans. Win win. Even if you weren’t moving, now is a great time to refinance a mortgage and pull out the equity to pay high interest debts. This is only for people who know they won’t just ring up more debt (so for you, and for student loans I recommend it)

Good for you on taking on a mortgage in your debt journey. I couldn’t stomach the risk. And I’m kicking myself now. Look at all the equity you earned along with essentially living “rent free” (or interest only as the rent!). I chose to pay down my loans first and by the time I got a downpayment I’m priced out of the market and stuck with renting a subpar place or moving out of the area. I guess it was a gamble either way though.

That’s an interesting thought–thanks for commenting! Our rates are actually really similar: our mortgage is 4.875% and our student loan is 4.3%.

We took on a mortgage while we had debt out of total ignorance. It was years before I’d ever even heard of Dave Ramsey. We bought more house than we probably should have, but we are grateful for the equity now.

Is there more to it than concern about when your daughter would start at a new school? I don’t see a lot of pros of moving unless you have more reasons.

There is more to it. I think I could fill another page with all the things swirling through our heads! Here are a few other pros:

– We want to live somewhere with less crime (our current area has been getting worse and worse)

– We’re on a small flag lot off a busy road, and we’d like a larger neighborhood where our kids could safely ride bikes and play with friends without me panicking

– We want the benefit of living in the community where we work. In our field it helps a lot to get new patients by meeting them through school, kids sports, neighbors, etc.

I understand wanting to be safer/better schools but I am in the team rent. Almost 300k in student loans makes my heart flip. There’s no making those suckers go away. You’d make so much head way on those and be on much better footing by paying them down while renting. We had 200k in student loans with just under 20k left to go and still rent. Would I like to buy a house, of course, but the stress of owning a home+ an astronomical student loan would be too much for me.

Tough dilemma. I love the idea of paying down your student loans. Perhaps you could set aside one years rent from the equity, then put the rest on your student loans. Maybe that would help the cringing from renting. it would be sort of like ‘living on last months income’ that some people do when they are getting out of debt, and you could put money aside that first year to either have for the next years rent, or as a down payment.

You might then refinance your loans, if you wanted, to decrease the payment, or continue to pay as currently scheduled and watch how much more goes against principle.

Nothing in the world wrong with renting, and you won’t have to deal with repairs and maintenance. The fewer surprise expenses you have at this point, the better.

Also, many many people buy their ‘forever’ home to later discover it was a ‘for a few years’ home. Don’t let that soothe you into making an unwise purchase. There’s a home one every corner. They’ll still be there when you can better afford it.

Keep in mind, economically we are somewhat due for a recession. If you sell now when it is “higher” and then rent a while, all whilst holding onto about 30% of your proceeds for a down payment and expenses, you may be in the position to buy more house as housing prices decrease. All conjecture, of course, but may suit your current position. And renting will allow you to “test” some neighborhoods for the one you like best.

Everyone has been saying that for the last two years. Yet the stock market went up over 20% last year! A recession is “always coming” you just don’t know how far out. Renting in a HCOL area where you plan to stay a long time isn’t the best strategy unless you’ve got no cashflow, credit card debt, or high interest loans. Have you done the NYT rent vs buy calc for the new area? I think the kids school and the business (it’s like a dental practice or something I venture) is a pretty strong indication they’d stay a long time. Renting could put you further behind.

I agree that timing the market isn’t worthwhile. I would suggest, however, that some consideration should be given to the sheer absolute quantity of interest that they will pay on student loans of that amount, even if the interest rate is lower than a credit card. It’s essentially a mortgage, and the amount you pay on something that large can easily be double the principle you owe because it takes so long to pay them off.

I do think Sara should continue. Investing for retirement, for that reason as well. It will take so long it would be a terrible idea to lose out on years of investing and gains. It’s also why I think that paying down the student loans by a large amount from the home equity, then maybe refinancing and deciding then how to best use their income after that is a plan to consider. At that point if they want to pay out the remaining amounts more slowly, at least they won’t be paying hundreds/thousands of interest per month, hopefully.

Wow – With this much student debt. I’d sell and rent in the new area. Renting a house at $2K is comparable to what you pay in mortgage and you wont have all the additional housing expenses associated with upkeep. You can then 1.) put a 20% down payment in savings as an emergency fund. 2.) pay a huge portion down of your student debt. 3.) be in a better position to buy (no contingency) 4.) make sure you get the house you want in the neighborhood you want. To me this is a no brainer in terms of debt payment and moving to a more desirable neighborhood/community and also reducing commute. Renting is SO MUCH CHEAPER than owning a home. This would allow you to possibly take on a new mortgage in a year or so with little or no student debt. Think of all the money you would save in interest if you put 200K towards your student debt!

I’m going to go against the grain here. First, we moved at the same stage to ensure our oldest had a year in an elementary school as the “new kid” before she hit middle school. Interest rates are low, and you’re moving to an area where housing prices are going up. BUY! Rents can go up, mortgages are stable. We rented our first year in our new town, which has the same dynamics, and probably paid $20K more for our house than we would have if we’d bought sooner. My parents just moved to our town and I’m a little sick about how much they are spending to buy a house, just 6 months after we bought ours. We may be “due” for a recession, but there is no denying that we’re all in a workforce shortage, so this is a little more unpredictable than a historic economic cycle.