by Hope

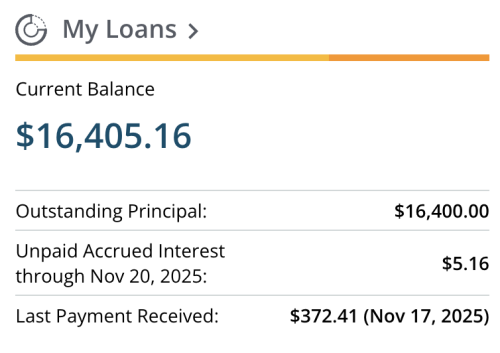

As of today, my student loan is debt principal is $16,400…we are on the move! You can see my end of October update here.

I don’t anticipate I will pay any more this month even though I do anticipate additional monies coming in. But I’ve learned better than to count my chickens before they hatch so I’m planning conservatively. And should be able to pay more than my goal of $2,000 per month next month.

Not Unexpected, but Unknown

I do have some expenses this next month that I am not sure of, so being cautious until I figure them out. They are:

- Transfer the registration of my car to Texas. I’ve decided to bite the bullet and make that change. It would have only cost me $25 to maintain my Georgia registration (it renews on your birthday every year and mine is next month.) Although, I have a legal residence in Georgia still, I don’t anticipate a return to live there any time soon. (And it’s my daughter’s apartment so I wouldn’t live there anyways.)

- Transfer my business LLC to Texas. In the long run, this should save me some money since Texas doesn’t have a state income tax unlike Georgia, but I know there will be some costs associated. Technically, I could hold off on this until 2026, but am preparing for it.

- Update my legal residence with my insurance. I don’t know how this will affect my insurance rate. Princess just got her own policy, so now it’s just me. I paid my 6 month premium in full so I’ll either get a refund or owe a bit more. Not sure.

- Source new health insurance. I’ve decided to make a move with my health insurance as well. The cost of my existing plan, even removing Princess, will quadruple in January. And since both Gymnast and I are living in Texas, need to find one that can serve us here. (Sidenote: He is going back to school in January. In fact, he’s taking his placement test as I write this. Woot!)

- Switch my driver’s license. Again, not unexpected. Just not sure of associated costs.

I’ve had all these things on my budget with ??? not knowing the costs. But I’m going to bite the bullet next month and get them all done.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Check with Gymnast’s school if they have student health insurance for him

Quadruple? This is such a mess and I hope people remember it when they vote.

Also, this may not be the most popular opinion on this blog, but your student loan rate is so low that I’d rather see you keep saving/investing more and not devote quite as much to those loans. The investments/retirement contributions will yield you greater returns. Keep at the loans, but maybe at $1,000/month and designate any unexpected windfalls or income to it. You need more in reserves.