by Hope

I had great intentions of posting so much last month. And then, well work!

Here’s a glimpse, a partial glimpse of how my month went work-wise.

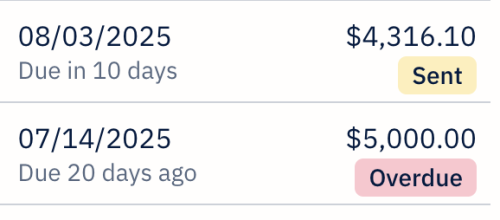

Client #1

And this is invoicing to one client. Ignore the Overdue note, that is a payment plan for a website. He’s paid 50% down, but the other two payments are due as milestones are hit. I should receive the remainder by the end of August.

This is my newest client. He’s also my lowest paying client right now. (Well, since client #3 gave me a raise last week.) But makes up for that in volume. He’s been with me since March.

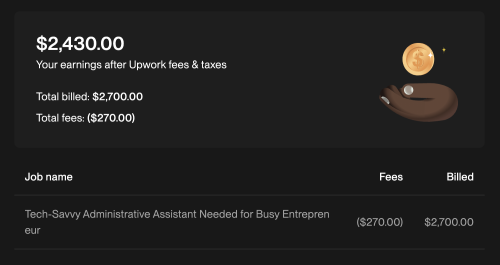

Client #2

I actually got to meet this client in person during a long weekend trip to Chicago. Don’t worry, the whole trip cost me less than $70. I used points for the flight, paid for one meal for Princess and I, and staying with her in her hotel that her new job is paying for.

My client paid for all my other meals outside of breakfast which was included with the hotel. And he drove me to and from the office. Win-win!

This client has been with me since February. Some week’s are great. And some are silent. He pays me $60 per hour these days.

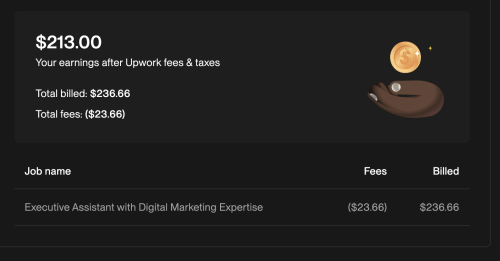

Client #3

I actually got a raise this past month, but won’t see it in my income until this month. But went from $20/hr to $40/hr – woot, woot! I only work between 2-7 hours per week for this client. But it’s been steady since either February or March. And I genuinely enjoy the work. And the people. (I really enjoy all my work and all the people with few exceptions.)

Other Clients

I’ve got 1/2 dozen or so other clients that are hit and miss every month for hours or projects. But these three above have been with me since this past spring. And they are all growing in hours, responsibility, and money. But phew, this has been a busy month.

Income Overall

Hopefully this gives you some insight into my income. For July, I received the amounts listed for clients #2 and #3, for client #1, I received a $2,500 deposit for a web project and just at $3,000 for June work.

About a 1/3 of all income goes to the government in one form or fashion. And the rest to budgeted items. I’ll get an update for my savings and debt out this week. *crossing fingers that I have a moment to breathe.

And I’ll finish that series on where the house money went too. Promise I’ve just been slammed with work! A good thing that I am so grateful for.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Chicago is my favorite city! Hope, how do you always have so many points to pay for everything, especially since you closed some of your cards? How do you earn points and what is the redemption value? How do you book the flights?

Oh boy, now for the questions that we hopefully get answers to:

1) What about the Color Purple play you mentioned seeing with Princess in Chicago? Is that included in the $70? A quick search says tickets start at $60 for balcony seats.

2) Are the indoor sports games and stuff you posted about doing in Chicago also included in the $70?

3) How you are earning so many points and how high are the redemption values? Now that you’re closing cards are you planning on having less points to rely on? Are you budgeting money for the perks that points used to cover?

4) The Chicago client: was it a business trip? If so, why didn’t they pay for your travel and accommodation expenses? If it wasn’t a business trip then why did they pay for all of your meals?