by Hope

I stressed ALOT about Christmas and what I could and could not do as far as gifts go. And I definitely waffled between making terrible decisions and staying strong. But I’m happy to report, that I spent less than $2 per child for Christmas.

Each of my children received 2 gifts from me:

- As I’ve been working through purging the house, yes, some more, I selected a book for each child. Some received re-gifted books and some new that I had never read. But in each one, I wrote a personal note about why I selected it for them and what I hoped they would get out of it.

- Then I spent several hours each week over the last month-ish typing of old family recipes, writing stories about each recipe, and finding related pictures of the food or from the story I wrote about the food. It’s not complete, but I felt good about where I wrapped up. And my boss was gracious enough to let me print them here on her 3 hold punched paper. The cost came in with buying 5 identical 1/2″ binders.

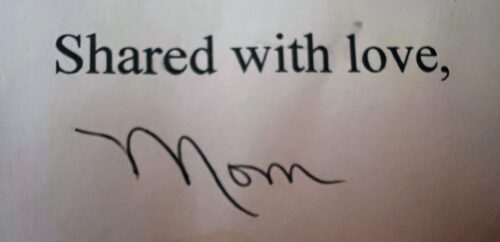

I wrote a couple of personal notes in each binder, that they will find someday as they work through them. (At least I hope. But I thought that would be a nice personal touch.) And I plan to create a custom cover for each binder and have them printed down the road. I also retyped the note my mom put in my recipe binder back in 2002 and added an image of her signature to make it a little more personal. Overall, I was happy with the gift, and they all seemed excited about it.

Don’t get me wrong, I did still spend some money. I purchased all the food for our Christmas Eve meal. There were 11 of us fed – 6 of us, 3 significant others, and two elderly neighbors we provided meals for. (We are still eating leftovers, and Princess was able to take food home for the rest of the week for her as well.) And the items needed for Christmas Eve games. But overall, this was the most frugal Christmas for me EVER. And it was magnificent!

I pray you and yours had a wonderful Christmas.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.