by Semify

If your home ends up with more licensed drivers than cars, the most practical thing that you could do is to share what you have. This may be easier said than done, however, and you may be wondering about what the best way to do it is. Keep reading to see some helpful tips that can make it easier to share a car with someone else and keep the chances of an aggravating issue low and manageable.

Find the Right Car

The first step that you should take is to find a car that’s going to work out for everyone involved. This may entail making some compromises so that it’s possible to find the line of best fit. As such, you should know the most important and practical features so that you pick the right car. This tip applies if you end up having to buy a new car after you know that you’ll need to share it. Otherwise, you could sell the existing car and buy another one if the existing car simply can’t work out.

Set Some Ground Rules

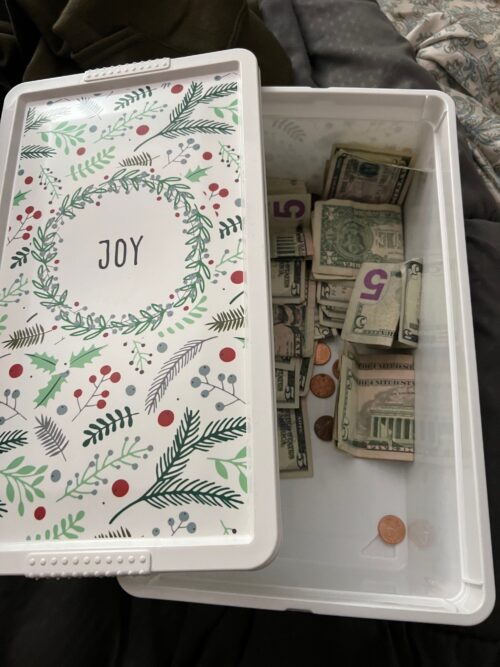

Next, you need to set ground rules that will govern the way in which you share the car. These rules should cover who buys the gas, how maintenance costs are shared, what the are penalties for getting tickets, and who gets priority at a time when everyone needs the car. These rules need not be set in stone, but it’s a great idea for you to have them in place from the start and change them as you go.

This may be even more important for a family with divorced parents, in which case visitation is often set by the parties and predominantly based on what’s reasonable for the child. The decision should also be convenient for each party based on their work schedules as well as what the court considers acceptable. In this situation, you don’t want to end up in a fix when you need to either pick or drop the child in question.

Leverage Technology

Keep the car in good shape and make the most of technology as well. This way, you may be able to improve driver safety and keep the occurrence of accidents to a minimum. Some of the technology you need will likely come with the car.

For example, the check engine light turns on when there’s an issue with the engine. On this note, remember that it’s safe to drive with the check engine light on for anywhere from 50 to 100 miles, according to Way. More technology that you can take advantage of is communication systems that make use of Bluetooth and that can help with the hands-free operation of mobile phones when someone is driving.

Have a Plan for Emergencies

Don’t forget that emergencies can take place when you least expect them to, throwing all your schedules into chaos. To begin with, it should be common knowledge that the average vehicle lasts for 12.3 years, according to Broadly. That said, the older your car is, the more prepared you ought to be for certain risks such as the failure of a part and such. Always make sure that there’s an emergency kit in the vehicle at all times, and that every driver knows the procedure to follow if they need to seek roadside assistance.

Create a Schedule for Cleaning and Maintenance

Last but not least, few people, if any, are happy to drive around in a dirty vehicle. This makes it important to come up with a schedule that you’ll use to keep the car clean and in good shape. This schedule should be fair, ensuring that each person has a particular role to play, which could be daily, weekly, or even monthly, towards keeping the vehicle well-maintained. This can ensure that the car is always in an acceptable state for everyone to use.

These tips should help you find the best way to share a car with someone else. You can avoid fights and unnecessary or even unexpected breakdowns that will cost you time and money. It will take some effort from everyone at the beginning, but with proper communication and compromise, it should work out perfectly.