by Ashley

In my last blog post, I mentioned 3 expensive house repairs we just had to complete. This was for roof repair, a plumbing emergency, and termite treatment. The combined total of these three was just under $2500. And I assumed our home-related repairs were finished for a bit.

Narrator voice: That was not, in fact, the end of the house repairs.

First, a hissing A/C

Last weekend, my next-door neighbor texted me that our A/C was making a loud hissing noise. They heard it when they were in their backyard grilling some food. I watched some YouTube videos and my husband and I tried to fix it ourselves. We blew out and cleaned the inside of the unit adding some lubricating oil. Unfortunately, the hiss did not subside. We called an A/C guy and $660 later, we were all fixed up.

Then an alarming email:

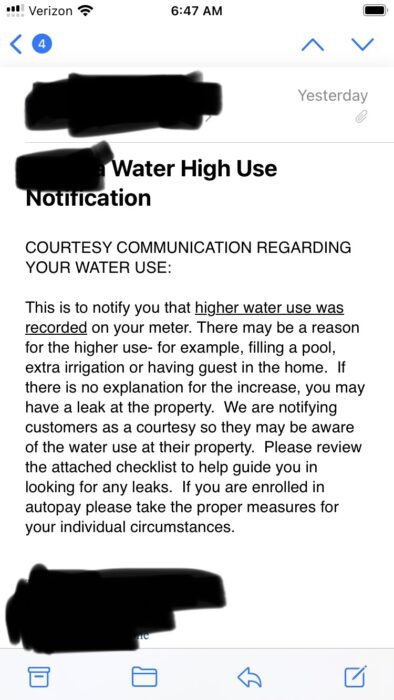

Just a couple days ago, I woke up to this email in my inbox:

We noticed last month our water bill was much higher than normal. We commented on it. We thought about it. We paid the bill and just generally dismissed it. Last month we didn’t get this warning email. So if last month’s bill was already high and it hadn’t warranted the email….I’m very nervous about what this month’s bill will look like.

So, yeah, now we’re afraid we’ve got a leak. In the meantime, we’ve turned off our drip irrigation and are hand-watering (as the irrigation is the most likely place where a leak could’ve sprung). We’re trying to “diagnose” it ourselves first but, if we’re unable, we’ll be calling another professional to come out and take a look.

And the last little bit of icing on the cake…

The other night after dinner I was washing dishes and – I sh!t you not – the handle of the kitchen sink broke off in my hand. I looked over at my husband and was like, “You’ve gotta be KIDDING ME!!!”

Luckily, this is a super minor/easy issue. Unlike our last emergency plumbing situation where water was shooting across the room, this handle looked like it could get a dab of JB Weld and just be stuck back into place. Not an emergency. But it just feels like a bad joke. How much stuff can possibly break in 2 months? Literally, friends, this is all within the past 2 months!

Car Payment

This is all pretty terrible timing given that I’ve been hoping and planning to pay my car off this month. After paying my normal payment this month, I still owe just over $3,000. I have another $1,000 planned in my budget this month, but I’ll need to raid my savings for the remaining $2,000ish. I’m still planning to do it….but I feel less comfy/cozy about it knowing that we’ve had all these unexpected house repairs and I worry about what else could be on the horizon!

Potential water leak aside (which we are still working to diagnose)….surely we’ve had our fill of home repairs and we’ll be good for a while now. Right?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!