by Hope

For the first time in a long time, I have combined my budget and my tracking into one spreadsheet. At the end of every week, I am notating all the money spent and received. While I have tracked my expenses pretty diligently for the last couple of years, I haven’t combined it with my income.

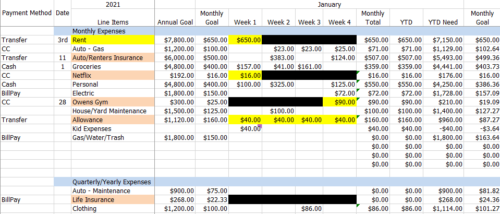

Here’s my end of January report for personal spending.

Each line has the annual budgeted amount, that amount divided by the applicable months (most are 12 month but there are a few that are more compact.) The following month subtracts the amount spent to date and then adjusts the YTD need and monthly goal accordingly.

I quickly realized there expenses I hadn’t budgeted for but that I want to track. So you will see the new line item Kid Expenses. I am not ready to add that as an ongoing budgeted amount, but I do want to track these specific expenses. It may need to be a line item in the future.

Notes on my January Spending

This month’s unexpected expense was an online driving class needed for Gymnast to get his driver’s license this summer.

You’ll also note that I did blow my whole modified no spend January so we can go skiing plan out of the water. I did end up buying groceries a couple of times and while most of the Personal Spending budget went to skiing I did dip into February’s money this last week of January. But overall, I’m pretty proud of staying on track.

I did finally break down and buy myself a few new clothing items…2 pairs of leggings, 3 work appropriate tops for $86. This was prompted by two things – I’ve been wearing the same leggings for YEARS, I’d guess most of them are 5+ years old and my favorite two pairs have holes in them. Typically, I would just keep wearing them, but now they are past the point of being appropriate if you know what I mean. And two, I am on video calls for hours every day with my new job, many times for Partners and C Level Executives, I needed to up my game as far as video call appropriate work shirts. While they haven’t said anything to me, I’m sure my staple of t-shirt and sweatshirt would at some point be an issue. Now I’ve got a work appropriate top for each day of the week.

I’ll post my full budget later this month, but thought this was a good time to show how January’s money was spent.

Meanwhile, here are budgeting apps you can use.

| Platforms | Fees and Minimum | Best for |

|---|---|---|

| Personal Capital | Free | Monitoring wealth and spending |

| Simplifi | Free | Manage money everywhere |

| YNAB | $84 a year or $11.99 a month (after a 34-day free trial), free for students for 12 months. | Personal budget tracking |

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

I can’t say I really understand your budget or budgeting methods. In the case of personal or gym membership you exceeded your own “goals” ( by $150 and $65 dollars respectively) and yet shorted your “goals” on items like gas\water\ trash, house maintenance, and electric. It seems to me you should. be shifting that money around if you set reasonable and realistic budget amounts.

You’re kind of lucky that you have a nice salary right now, someone living on the margins and going from paycheck to paycheck would find themselves in trouble eventually if they did not fund real costs for line items like electricity(where fluctuations from month to month can bite you if you don’t plan for them) and instead overspent in categories called “personal.” I also don’t understand why kids expenses would not have been a line item when you made this budget, it generally has made up a good portion of your budget in previous years.Good idea on making kids a trackable expense though! Where is your gifts category or holiday category? You know that Christmas comes every year as well as birthdays. What about family travel? You know you visit family in Texas and Gymnast may wish to visit dad in Chicago. Plan for these things.. You need way more line items Hope, unless personal is really a euphemism for slush fund and your tracking will only vaguely reflect where money is actually going.

I understand you’re excited and want to take the kids skiing but why do you have 400.00 personal unless it is only for this month. You’re going to spend more on car insurance than food with I’m guessing 3 kids on your policy. What car is your son going to drive and how old is he?

Yes, $400 personal is my catchall. So months we blow through it and sometimes it sits. It’s not free money though, I work for it…have to make it to the gym at least 4 times per week to get each $100 otherwise it goes to debt and I have no spending money. Great motivator for me.

Yes, my car insurance will definitely go up in July when Gymnast gets his license. No decisions made about car situation yet. Their dad has been making rumblings again in that area. Here are my current thoughts:

1. Assuming Princess goes to the school she wants, I will give her a Uber allowance. Will save a ton on car insurance, parking, etc. if she has to take a car.

2. Gymnast and I will share a car. I rarely go anywhere and would be easy for us to do.

But nothing is set in stone…and have have 6 more months until he can drive.