by Hope

In NoIt’s time for another debt update. And I’m really excited about my progress. I’m less clear on what my plan is. I’m kind of flying by the seat of my pants right now.

When I know I have the bills for the next month covered, I start putting extra income towards debt. And I was able to make some extra payments this past week.

Current Debt Load as of 9/10/18

(as of 10/14/17) | |||

|---|---|---|---|

| Student Loans | $34,587 | 2.88% | $0 (income based deferment) |

| Car | $6,162 | 7.00% | $0 (deferred until November) |

| Credit Card | $3,782 | 17.00% | $0 |

| Collections 3 (Ex-husband) | $3,804 | 6.25% | $246 |

| Collections 2 (Apartment) | $499 | $0 | |

| Self Lender | $0 | 10.57% | $0 |

| Total | $48.834 | $246 |

Debt Notes

- First off, I paid off my Self Lender loan last month. A month ahead of time – woohoo! And received my payout last month which funded my emergency fund! Even more exciting is that I’m receiving a $10 affiliate check from them shortly, someone else must have thought this was a good idea. I know the 10% interest is kind of high, but it was like a forced savings plan and that was really good for me! I would do it again (but I’m not.)

- Because I have been able to pay extra every month on my car, I was offered a 2 month deferment (September and October.) I decided to take advantage of it and pay the extra towards some other debts the next couple of months. In November, I will return to paying $400 per month.

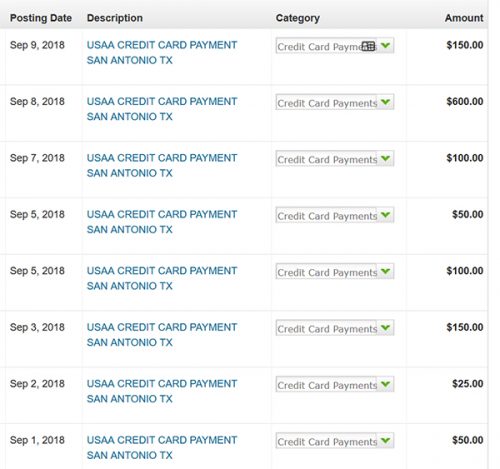

- I haven’t made any more progress on my credit card. Last month, I dropped my on-going total right at $1,300. But that doesn’t mean I’m not paying on it. I continue to use it as a rolling credit line – use it and pay it. Here’s a screenshot of the payments made in the last 10 days. (Sea Cadet is an authorized user on this card as well, his only credit card access and also uses and pays it immediately.) While the balance hasn’t dropped any more, I do not have to designate a separate line item to make the month minimum.

- As you can see, my largest debt payments this past month has been towards Collection #3. I’m thinking this is the debt I would like to target now. A change from my original plan to pay off the credit card first.

Just a side note, I did read the comment regarding my student loan, and while it is in deferment until next spring I am looking at starting to pay some on it.

I am now ready for your guidance. You can see my last debt update here. You are seeing my twice weekly anticipated and actual spending and income. I believe I’m getting back on stable ground and ready to make a plan of action to KILL my debt. WHAT should I target?