by Ashley

Friends – I have a fun mini-milestone to share today….

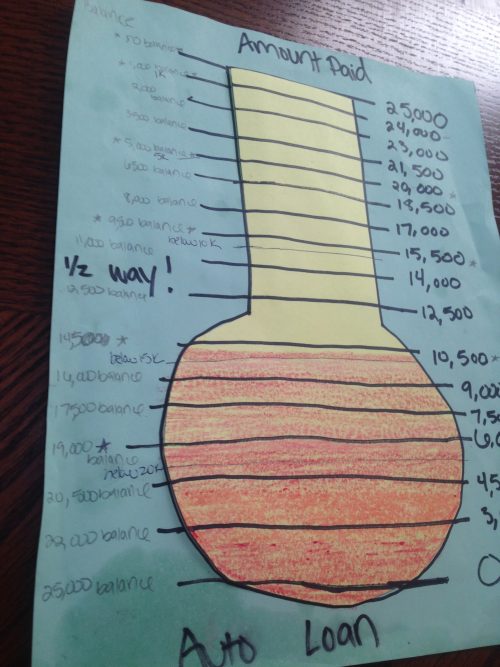

Remember my debt thermometers?

Please ignore grease stain on bottom left…the thermometer hangs by the stovetop so it occasionally gets grease splatters. Gross, I know. But the dang thing has sentimental value so I refuse to simply make a new one.

Well, they’ve continued to hang on my fridge side-by-side: the fully filled-in Wells Fargo debt thermometer, and my still mostly empty Auto Loan debt thermometer.

I love having them side-by-side because I can remember feeling like my Wells Fargo debt was going to take forever to pay off, and its so nice to look back and remember what it felt like to kick that debt’s butt!

For a number of reasons, my auto loan debt hasn’t been going away nearly as quickly. Part of this is income-based (our income last summer was rockin’ and this summer it hasn’t really peaked like it did last year). But the other big reason is because I took my attention away from the car for a few months. I was really focused on knocking out a couple of smaller debts so I could feel some of that psychological boost that I was so desperately craving. So I put the car on hold for a few months until I could knock out the license fees and one of our medical bills. As a result our auto loan debt has been hanging steady just under $16,000 for months now (literally. See debt updates from January, February, March, and April – all of which my car loan debt was between 15,000-16,000. That’s a LONG time to be stuck in that holding pattern!)

ANYWHO…

Now that I’ve officially eliminated those two pesky debts, I’ve turned my attention back to the car loan. And let it be known that May 2015 is the month that I’ve officially busted down below the $15,000-mark!

I still have a long way to go. I haven’t even reached the half-way mark (though its just around the corner!), but getting below $15,000 owed felt significant of its own right, so I wanted to share this mini-milestone with you all!

Some of my favorite comments are from casual readers who happened across the blog one way or another and used it as motivation to get rid of their own debts! One comment, in particular, resonated with me. The commenter said she had seen one of my posts (several months ago) where I announced I was going to tackle my car loan. Obviously I ended up putting it on the back-burner for several months, but this reader did not. She used it as inspiration to kick her car loan’s butt and now owns her car outright – no payments owed to anyone!

I know that feeling (prior to this car, I had outright owned my two previous vehicles). It feels GOOD. And I want it back. I’m coming for my car title, PenFed. You guys better get it ready to mail because it will be MINE before you know it!

MWHAHAHAHAHAHA (<my evil debt-paying laugh) ; )

What mini-milestones have you celebrated recently?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Congrats Ashley! I think the thermometer is a great way to get some satisfaction in seeing a big balance get closer to $0. Last week I was able to pay off my undergraduate loans. That felt so good after 13 years of it. I still have graduate loans that I need to tackle but at least now I can snowball my undergraduate loan payments to my graduate loan payments. Yay for milestones!

Wow, that’s incredible! Great job!!!

Cool!

I like this idea… Maybe I’ll make two for my mortgage. One thermometer for the original debt I took out, and the second to track progress on the refi amount.

Do it! It’s so silly, but its a really great feeling every month when I get to color in that little bit. Honestly, if I were to do it again I would probably do it on a poster-sized paper so the increments could be smaller (and, therefore, you color more with each payment). It’s been really motivating for me!

I have to tell you how much you motivated me with your thermometer! The visual is so great that I created my own. I’m actually not creative enough to make a thermometer, so I created a graph on graph paper and watched it go down each month as I paid off another debt! I finished one in the fall, then started another one right away and it will be paid off in the fall of this year. It’s highly motivating to visually see it go down each month! Thanks for the idea because it has really helped!

YAY!!! I’m really glad to hear this! I definitely don’t think my little thermometer is anything to write home about (it was very quickly and crudely drawn up), but I just love getting to fill in a bit each month when I make my payment. I love that you’ve found a way to do the same basic thing but in a format that works for you!

Woot, that was me who now has a paid off vehicle (as of last Thursday). The title will be in hand shortly and I won’t feel the economic relief til next month, but the car is MINE.

HOOOOORAY!!!!! Way to go, Kristina! That’s really, really cool!

Last Friday I paid down my student loans to below $30,000. This is a big milestone for us – we have less than a year left according to our debt tracking and the 30’s were the flipping WORST. They seemed to take FOREVER!!!! I don’t even remember the 40’s, 50’s or 60’s – they flew by.

Anyway – congrats – every little bit helps!!! You and your husband have come so far in the last year and you should be proud of all the hard work you’ve put in! I love the thermometer!! When you feel paying off debt is stupid, it can help encourage you to keep going.

That is incredible!!! You’ll be debt-free before you know it!