by Matt Fildes

Hey everyone,

Ok, so on Thursday I posted about my latest accomplishment- I paid off debt Sallie Mae 03! But what I didn’t post was… everything else. A couple of you asked if I could post more about me- a valid point which I’m more than happy to share, knowing that people want to hear more than just “blogging away debt”.

So here’s what lead me to…well… here:

I’m currently 28, having just turned 28 last month. I was born and raised in the beautiful (not really, but still awesome) Buffalo, NY with my 2 parents, a younger sister (2 years) and brother (5 years). We lived a very comfortable (for us kids) middle-class life in the suburbs (translation: we looked like we had more money than we did). I grew up with Buffalo Bills, Buffalo Sabres and chicken wings- 3 of my favorite things to this day. Sometime around the age of 10, I decided I wanted to be an engineer, not just any engineer, an Imagineer- a Disney cast member who designs everything in the theme parks. This was my dream and to some extent, still is. After a long road through high school, in which I was quite the trouble maker, I got accepted to a few schools for Mechanical Engineering, two of being University of Miami (FL) and University at Buffalo. Going to U of M was also one of my dreams and I made an early decision to go the summer before my senior year. Sometime during that year, I got the bill for the 1st years tuition- $40,000 FOR. ONE. YEAR. Like I said earlier- I was a screw off and didn’t do any favors for myself in terms of scholarships and grants. After a long talk with my parents we decided that going to University at Buffalo (UB) for $4,000 a semester and living at home made way more sense than going to an out of state, private school.

My freshman year of college I really turned things around- I had relatively high GPA for the program (3.8), worked nearly full time and helped coach my high school wrestling team. This coaching gig gave me the itch to go back and wrestle myself- in college. In high school, I was good but definitely not great. UB was/is a NCAA Division 1 school, meaning you have to be pretty awesome to excel there. So, I transferred. To a private Catholic University in Erie, PA. Why? Because it was the only Division II school that had both a wrestling program AND mechanical engineering. Well, private Catholic University means BIG $$$ (and even more $$$ since I had to take summer classes to catch up due to “nontransferable credits”) and somehow in the course of me deciding the transfer, I lost sight of why I didn’t go to my “dream school” in the first place. Was it a great experience? Most definitely. I met my lifelong friends, gained a tremendous amount of skills wrestling in college and graduated with a degree, a pretty sought after degree, or so I thought…

At the time I graduated in 2009, the economy was already deep in recession (something I think we all remember). It’s hard to find someone who WASN’T affected by all of it. Anyways…getting a job was tough, really tough. I remember sending out 15-20 resumes a day and not getting any calls, let alone interviews. I wasn’t the only one. Of 13 of us in the program, only a couple (2-3) had jobs lined up after graduation, and it was for firms they had internships with. The fear of not being able to pay bills and having to move back in with my parents kept me motivated. Thankfully, I was lucky enough to get an internship in my last semester with the Federal government to work in construction and equally thankfully they had a position open that I could have when I graduated. Problem was, an intern had to work 600 hours before they could be hired full time, so I worked 70 hours a week, while going to school full time (I had to give up wrestling to achieve this). The day after graduation I had a full time job (but not great in the pay department) and was in full time student loan debt.

As you’ve all seen from my initial posts, I graduated with $110,000 in student loan debt (now matter how many times I write, it’s still crazy). For 2 years after gradation, I lived in a basement apartment (which had windows, albeit, not good ones) and paid interest only on my largest batch of student loans- the private ones with Sallie Mae. As terrible as it was for a while ( I was only making $50K at the most while I was with the government) this set me up to be disciplined to pay off my debt. Even paying interest ONLY on half I loans my payments still added up to $700 a month. It truly scared me with what could happen if I lost my job and couldn’t pay (reading student loan horror stories on the internet didn’t help any). So I worked form the ground up, putting whatever I could to pay off my debt, even taking a 2nd job for a year busing tables. This also lead to me taking up a whole bunch of hobbies that really don’t cost that much- playing guitar, here’s my current guitar:

,surfing (yes, you can surf Lake Erie- look up YouTube videos), and here’s proof (that’s me, over the summer):

longboarding (the skateboard kind) working out, running and reading. From my intro post, here, and here, you can read my journey form the last five years. I currently “own” a house, which I share with my GF and our 2 dogs: Harlow (the white one, a whippet mix) and Bubba (an Australian Sheppard mix), both rescue dogs:

Ok, so that’s pretty much the run-down of my bio. I think a good reason why I don’t post too much info about myself, is because paying off debt is boring, like REALLY boring. I can count on my one hand the amount of times we’ve “gone out” since last summer. I’ve paid off over $48,000 since September of ’09 and in order to do that I’ve cut a lot of money absorbing things out of my life, which gives me little to discuss other that what I’ve posted in the past. What I do love posting about is what’s come up in the past week and what I’m expecting in the week to come that lead to me being able to put a good chuck onto my loans.

I guess here is where I’m looking for some input- what do you guys want to see? I could post weekly updates like I was doing with more insights into my financial plans, or I could most more personal items about my life, like this post…or some mixture in between. Just let me know in the comments!

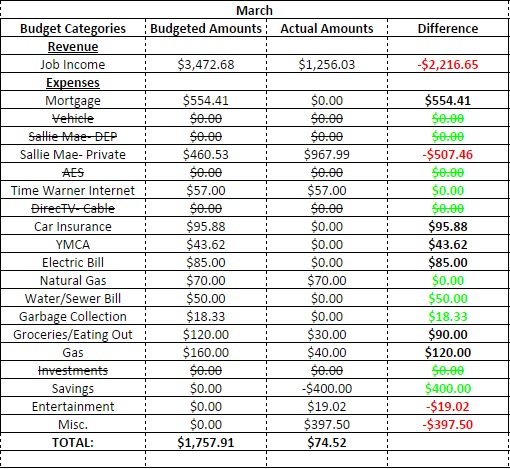

Since this post is already long enough- here’s a quick look into my monthly budget thus far. Big ticket item- had to pay $397.50 at the dentist’s for a crown which came out of my slush fund.

And here’s where my debt balances are:

| Loan Name | Interest Rate | Original Balance- May '09 | Current Balance | Total Paid Off |

|---|---|---|---|---|

| Sallie Mae 01 | 5.25 | $27,837.24 | $24,462.48 | $3,374.76 |

| Sallie Mae 02 | 4.75 | $22,197.02 | $19,189.15 | $3,007.87 |

| Sallie Mae 03 | 7.75 | $20,692.10 | $0.00 | $20,692.10 |

| Sallie Mae 04 | 5.75 | $10,350.18 | $7,723.61 | $2,626.57 |

| Sallie Mae 05 | 5.25 | $6,096.03 | $4,969.48 | $1,126.55 |

| Sallie Mae 06 and 07 | 4.75 | $6,415.09 | $0.00 | $6,415.09 |

| Sallie Mae- DOE 01 | 5.25 | $5,000.00 | $0.00 | $5,000.00 |

| Sallie Mae- DOE 02 | 5.25 | $3,000.00 | $0.00 | $3,000.00 |

| AES | 6.8 | $9,000.00 | $0.00 | $9,000.00 |

| TOTALS | $110,587.66 | $56,344.72 | $54,242.94 |

Note to all: I will be now focusing on paying Sallie Mae 05 (the next lowest balance). Interest rate does not concern me at this point since I should have these paid off quick enough that it won’t have a large effect.

Thanks for continuing to allow me to post on this blog and thank you to all the comments on my last posts!

Stupid question, but why does the total paid off and current balance not add up to the total for several of these? (Ie sallie mae 05).

Id like to see a few more posts from you about long term financial goals, for example retirement savings. Missing out on tax advantaged accounts when you are young means you miss out on a lot of long-term money. How are you planning to address this? Are you saving for other long term life events? Have disability insurance? Do you depend on your girlfriend for half the expenses, or would you be able to make it on your own? Dont answer anything you feel is too nosy, but I like reading this blog to see how people plan their overall financial lives, not just the balances on the loans.

Thanks for stepping in and blogging, hope it is helpful for you.

Well…because I forgot to change the totals so they matched, lol. Sometimes I do that. I’ll change this later to match.

Anyways, yes…right now I’m deferring putting into a retirement account while I pay off debt. I was putting into a retirement account for my entire time with government and my current employer, having only stopped my contributions in September, which were/are in the forms of a 401K. My plan upon being debt free (and I will post this again in a future update) is to contribute 4% with my employee (enough to take advantage of their matching) and then contribute a few hundred bucks into a Roth IRA. I haven’t really worked out the details, yet, but have thought about it a lot. Saving for long term events- not at the moment. No disability insurance- I don’t feel the need. And lastly- my GF’s and my finances are completely separate (seeing as we are not married) so we survive completely independent of each other.

Hi Matt,

thanks for telling us a little more about yourself.

And good luck with the further debt reduction.

Thanks Kili!

I enjoy seeing you kill debt quickly and living off a pretty small budget (except for the student loans). I would be interested to know your future plans after you get out of debt. Keep up the good work!

Thanks Juju. Seeing as you not the only person wanting some insight into my future plans, I’ll make that make next update. I haven’t thought about it much, so it looks like I have some thinking to do this weekend, lol.

I’d be interested in hearing about how the things you’ve given up have affected you. Do you have a social life? What do you miss most during your laser focus? Are there any hobbies/items you refuse to give up during this point in your journey?

It seems like a lot of people are asking about this so what I’ll do is I’ll write a post, most likely this weekend, describing what has changed in my social life from when I began my debt journey. So…stay tuned!

As for the hobbies…the hobbies I described in my post I haven’t given up- playing guitar, surfing, skateboarding, etc, etc… As for the ones I have given up- I love golfing, like LOVE golfing. When I first got into it 4 years ago, I played with a set of clubs I got for free from my grandfather (hand-me-down) and I was playing on municipal courses. It was relatively cheap to when I wasn’t very good. And since I’m really competitive, the better I got, the more money it began to cost (i.e. playing better courses, buying better equipment) So, when I decided to really hunker down on the debt payoff, I gave this up seeing as green fees have seemed to become astronomical and I didn’t want to buy a $1,000 set of iron and a $300 driver. It was easier to just give in up completely than face the frustration of not being as good as I thought I could. Also, I mountain biked a lot, but decided to sell my bike last spring since it’s about the only piece of equipment I own that was worth something to somebody else, lol.

I really hope you would reconsider skipping retirement contributions.

Let’s say you make 55k a year. Based on standard exemptions and deductions 7250 of your money is being taxed at 25% + 6.5% NYS. At 4% contributions $183 would taken out of your pay pre-tax per month. But, that $183 is only $125 after taxes. So really, for $1,500 out of pocket per year you could get $2,200 FREE from your company. $1,500 out of pocket for 4,400 in a 401k should be a no brainer! At your payoff rate a small 4% contribution would only extending your loan payoff a 3-6 months

I really do admire your attitude and determination. That’s something I didn’t really have with our student loan debt (which is why we will probably be paying the full 20 years on federal loans). But, I think delaying your loan repayment a few months to have some balance in retirement is worth it. This is especially true since you’ve gotten your loans down below 6% (really ~4.3% when you count the SL interest deduction). The interest on your loans is near or lower than assumed yearly market increases. Therefore money in a retirement account will grow faster than your student loans will cost you.

My rule of thumb was to contribute to my 401k to reach the match until my 6.5% or higher loans were paid. After that, I upped my 401k contributions to lower my tax liability (get as much as I can NOT taxed at 25%).

Hey Angie- Trust me, I’ve run the numbers and I certainly does disagree with you when it comes to being the most efficient as possible when paying down debt, while also saving. This was something I even sought out a CPA about and we came to the conclusion that yes, I’m missing out on “free” money from my company plus lost opportunity cost, but I’m making up for it by 1) paying down my debt quickly, I’ll be debt free (knock on wood) in 19 months. 2) the financials aspects don’t outweight the psychological aspects. Having more money in the pocket every week to pay down debt and the decreasing stress that comes with it equal more than the few percentage points of cash I would be getting from my company. 3) extending my debt paydown 3-6 is effectively increasing my paydown calendar by 20-40% That’s a lot! If I were on a 10 year plan right now, I would contribute and I wouldn’t have to think about it. 4) I’m disciplined enough to have my retirement caught up in only a couple months after my debt is fully paid off.

If you are really on track to pay them off in 19 months contributing might not delay your repayment at all, or at most 1 month.

Hopefully to give you some perspective:

Right out of college, my husband only put into his 401k enough to hit the match (engineer, similar salary and match %). Over 4.5 years there was 29500 in contributions to the account (17500 his and 12000 match). Had he not contributed anything, we would have had 12k extra to payoff more loans after taxes. That was a drop in the bucket of our loan balance at the time (200k?). He left that job in 2012 and the money has been growing untouched since. The balance is now over 50k, our largest asset, and accounts for nearly 1/3rd of our total retirement accounts! Had he skipped the contributions we would have maybe 15k less in debt right now. 50k > 15k any day of the week.

If you count gains proportionally, the 12k in contributions from his employer is now worth 20k. So although the tiny amounts of “free money” seems like nothing in the short term, it will compound for the rest of your life. Not so much for “savings” on loan payoff which only compound while the loan exists. For retirement accounts time matters almost more than contribution amounts.

Alas, emotions could drive the decision if its truly that important to you. I get fired up not having my dollar live up to its highest potential. So for me the most emotional thing for me to do is to follow the numbers! On minor differences like balance vs interest rate it usually doesn’t matter too much. But on this I think you may be costing yourself a lot over the long run.

I apologize for the crazy long comment. I don’t intend to come off harsh but rather show you that it will make a minor difference in your payoff but a major difference in your retirement.

Not to jump on Angie’s coattails again, but she really covers it well and I completely agree. It sounds like she and her husband are young…can you imagine how much that $50,000 is going to be by the time they retire?!

Good call on not going to UM – I went there because my dad worked there so I went for free but dropped out (biggest regret of my life). I also worked there 30 years ago and back then tuition was over $1000 a credit because it was a private university – can’t even IMAGINE what it is now!!!

Yeah, I wouldn’t even want to look, lol. I read a Yahoo Finance article about the most expensive colleges to go to per year and if I’m not mistaken, Gettysburg University at 60K per year was tops. This was a year ago, so I’d imagine it’s even higher now. I’m sure UM is right there not too far behind.

I was one of the ones that asked for more personal stories so THANK YOU!

i like having the mix – personal and money. I didn’t know you had a frugal lifestyle (And have had for a while). I think it would be interesting to hear a little bit about how this has affected your social life. You’re still young enough that it should affect some things even with a girlfriend.

How does it affect your dating life? is she in a similar financial position? How did you get her on board.

100K for undergrad is insane – we really need to rethink education in this country.

Hey Debtor- I’m going to post about changes to my social life, hopefully, sometime this weekend.

On the undergrad loans- yes, it’s a broken system. Even graduate programs are extremely pricey and it’s harder to qualify (from what I’ve read/heard/seen) for scholarships and grants to pay for it. Here’s a story- my brother’s goal ,for as long as I can remember, was to be a MD. He just recently graduated as a biomedical science/pre-med student. After running the costs for 4 years of med school, plus room and board, 5 years (typical) for residency (working but making very little, meaning you can’t really start paying off your debt and the interest accrues), what doctor’s have to pay annually for their malpractice insurance all compared to their average pay, it just didn’t make sense to pursue it, for him. For others, it’s probably not even question, but for him, he didn’t want to be paying off that much money until he’d be in his 40’s or 50’s. So he decided to go to grad school to be a PA. He can’t be only one that’s had this same thought, so its seems to me that our education system is keeping bright people from seeking out careers that are really beneficial to society. Crazy.

Thanks for the post and sharing so much about yourself, Matt! I’ve been a reader here from the very first post by Tricia, and the reason I’ve stuck around is the personal connection. There are plenty of personal finance blogs written with a robotic numbers mentality; I like to read how finance plays out in real life, affecting daily living and decisions.

Ditto what Angie said. I cringed when you said you contribute nothing to retirement. I’d actually be ok with it, but not when you have a company match. Depending on the match, you are passing up an immediate 50-100% return on your money. The tax advantages are great too. Angie spelled it all out very well. Please think hard about contributing to get the full employer match.

I’ve enjoyed all your posts and am looking forward to reading more about your debt journey.

Let me third the comments re: contributing to retirement, at least up to your company match. A no -brainer! Not everyone is so fortunate to have a company match, please take advantage!

Great post. So why did you leave the Federal Government, is the pay better in your new job?

A couple of reasons- 1) yes, better pay 2) no loyalty (that I saw) in the government 3) there were too many witch hunts if don’t go as planned (they never do) 4) wasn’t really learning that much among other, more personal reasons.

Matt,

Thanks for sharing your story. It’s nice to know that there are other guys our age out there who are in this situation, and also working really hard to make it better! My story is very simliar – graduated in ’09 also, and I remember going into college in ’05, the economy was looking bright, and it seemed that by the time we all graduated, we’d be fine. But after 2008, it was horrible. I think I was the only one at graduation in my program who had a job offer with benefits (very low pay but still). Everyone else had to pretty much move in with their parents and try to make ends meet.

I’d be interesting to hear how you deal with the psychological aspect of your debt and personal finances – both from yourself and how other people treat you. I feel like there is such a stigma with this situation, specifically when you’re a man and an engineer. I remember family members saying things like “Well are you sending out your resume?” Umm yeah 10-15 a day. Sometimes they just don’t understand.

And I love to see that you keep active with hobbies too!! Any tips for hobby/free-time on a budget?

Thanks,

Greg

Thanks for writing Greg- I knew I couldn’t have been the only one out there in this situation! Yeah, there is definitely, definitely a stigma. It was much worse when I was right out college since 1) I had expectations going into an engineering program with the thoughts of being pretty well-off upon graduation 2) my family, I think, had the same expectations 3) I was very, very embarrassed with my situation. When I was busing tables (at a yacht club, my buddy got me the job since he was also working there), diners would ALWAYS ask me what I was going to school for. It was weird having to explain to them, not only did I graduate, but I was a working mechanical engineer. But now- I just tell people why I don’t buy certain things, like golf anymore, go out to eat, office pools, going out for lunch (which is a big one). It seems that when I tell people my situation (which I’ve only done in the past 2 years), I find there are more people than I thought who are very similar situation with the loans and also feel like they shouldn’t spend what they spend, but do anyways. And now that I’m pretty open about these things- the tables have kinda turned in a sense. I feel that I’m more respected with my peers now that they know what I’m doing that I’ve done and plan to do to get here. And not only that, but I’ve inspired a few others, personally, to attack their debt, too.

As far as the hobbies, most, if not all the things I currently do have a large upfront cost (surfing- I had to buy the boards, guitar- obviously the guitar and amp) and I bought everything used, or when it was on sale. My newest guitar I got brand new, 40% off it’s original price. But once the up front purchase is made, there’s no real additional costs after that- going to the beach is free, so is picking up my guitar. However, I did give up golf due to the high cost of green fees and I gave up mountain biking, since I sold my bike.

Hope to hear from you again.

I feel ya – even when I landed my great corporate job – I still worked part-time at nights and weekends at the retail store I had worked at before. It was extra income and fun for me. Unfortunately, colleagues would come into the store to shop and look at me like I was crazy for still working a minimum wage job. I felt like I was being judged, but I just kept going. I was doing what I needed to do to meet my goals. Everyone has a story.

Congrats on paying off Sallie Mae 03! That is a huge accomplishment. You are really doing great with your debt payoff. I enjoyed hearing stories about your background and your personal life. I like your debt payoff and you have embraced the frugal lifestyle. You seem to have a good payoff plan are laser focused on it! Nice job.

Thanks Mary!

I like the mix if personal info with debt reduction! A huge component of debt repayment is the psychology of it all. I think it would help other people to hear about what you struggle with and see how you overcome the urge to spend. And some people may have advice for how they overcame similar struggles.

I can totally relate to your Great Recession graduation time line. My husband graduated law school in 2009 and it certainly had an impact on us. It took a full year before he found a full time job in his field (he did contract work in the interim at a small law firm). But the uncertainty from that time is what started us on our rapid debt repayment. Good luck with your journey!

Hey Judi- glad to know there’s others out there besides me that was so effected by Great Recession. Good luck on your journey too.

As a fellow Buffalonian, thanks for the post!! As you know, Buffalo has tons of free activities in the Spring and Summer (especially concerts) so I look forward to you posting about taking advantage of this activities -you can still have fun going out for free!

Thanks Christie. I’m living in Erie now, but I like to say that Erie is a mini Buffalo, but with beaches. Lots to do down here for free too- concerts nearly everyday of the week, festivals every weekend, you name it. It’s really an enjoyable place to live.

As an old married lady with four kids, our oldest just in her first year of college, I really want to say Good Job to you. Its scary to think about how these decisions now will affect my daughter for years to come. I hope that my girl will be able to stand tall and deal with her results as well as you have been. You are great example that working hard and focusing will get you where you want to be. That example is few and far between so good for you!

Thanks for the kind words Kathy, they really mean a lot.