by Matt Fildes

Good afternoon friends and Happy Tuesday!

It’s that wonderful time of the year again, the time everyone scrambles to do their…taxes. Now normally, this isn’t too bad since I’ve typically gotten a pretty nice refund ($400-500) from our government, but this year not so much.

Back in September (see my update here), I made the decision to withdraw my retirement account I had with the government to help pay down my loans (I had help with my decision- I went to see a Dave Ramsey ELP/CPA, who agreed with my plan). Well, when I withdrew the money, I chose to have the 25% federal taxes plus the 10% penalty immediately withheld. I did not have the option to withhold state or local taxes. So, even though I’m getting a couple hundred dollars back from the Fed, I still owe PA $753 and I’ll owe the city about $245 (I haven’t filed my local taxes yet, but estimate is pretty easy- 1%). The good news is I knew this was coming since I withdrew my account., so I took the money out of my slush fund to pay, which I’ll do the same for my local taxes. Once I receive my refund, I’ll put this money back into the slush fund.

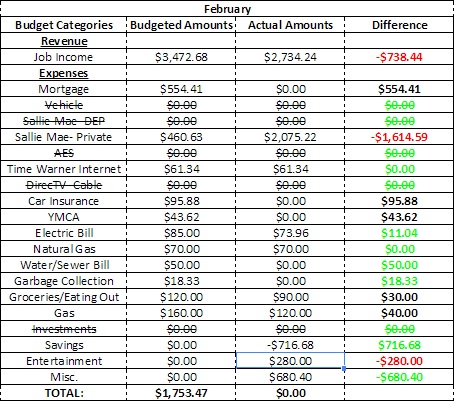

Here’s where I’m at with my monthly budget:

My slush fund currently has a balance of:

Slush Fund = $1,839.89

After the week of paying down student loans- Here’s where my balances shake out:

| Loan Name | Interest Rate | Original Balance- May '09 | Current Balance | Total Paid Off |

|---|---|---|---|---|

| Sallie Mae 01 | 5.25 | $27,837.24 | $24,462.48 | $3,374.76 |

| Sallie Mae 02 | 4.75 | $22,197.02 | $19,189.15 | $3,007.87 |

| Sallie Mae 03 | 7.75 | $20,692.10 | $655.99 | $20,036.11 |

| Sallie Mae 04 | 5.75 | $10,350.18 | $7,723.61 | $2,226.57 |

| Sallie Mae 05 | 5.25 | $6,096.03 | $5,356.99 | $739.04 |

| Sallie Mae 06 & 07 | 4.75 | $6,415.09 | $0.00 | $6,415.09 |

| Sallie Mae- DOE 01 | 5.25 | $5,000.00 | $0.00 | $5,000.00 |

| Sallie Mae- DOE 02 | 5.25 | $3,000.00 | $0.00 | $3,000.00 |

| AES | 6.8 | $9,000.00 | $0.00 | $9,000.00 |

| TOTALS | $110,587.66 | $57,338.22 | $53,249.44 |

Now that my slush fund is significantly lower, I can feel the urge to start bringing it up again. I’m going to truck through and continue paying down my debt until I can’t help it anymore (my threshold has always been $1,000).

Nothing else exciting to report on for the past or the coming week- just trying to stay warm up here the Northeast. We’ve had below 0 temperatures in the mornings and over night for what seems like at least a month now. Hope everyone is staying warm where you’re at!

Nice job on nearly paying down Sallie Mae #3. Looks like it’ll be a loan of the past in just a week or two. It would be awfully tempting for me not to just pull from the slush fund to get rid of it.

Which loan do you plan to work on next?

It is very tempting, trust me, but I’ll it have it knocked out next Thursday. I think of it as a challenge to see how much patience I have, lol.

So after this one is done, I’m going for #5- the one with about $5,000 left. I should be able to pay that one down by the beginning May.

You are really doing a great job – I’m with Walnut, which one comes next? I’m betting you’ll knock that one out in no time too!!!

Thanks Sue! I’m planning on attacking #5 next. I should have it paid off by the beginning of May if all goes well!

Great job and keep us posted when you get that #3 loan paid off! And then you can focus on the next loan – when do you hope to have that paid off?

I know when you first started you were selling stuff to put more towards debt – is that still continuing or did you run out of stuff? Any new ideas to keep your momentum going? Are you feeling any burnout or are you still highly motivated?

I should have it paid off by next Thursday and I’ll immediately start paying off #5. If all goes well, I should have this one paid off by early May. April is a 5 paycheck month for me (5 Wednesdays’) so that will really help.

I don’t have anything right now that I feel I could just put on Ebay for a quick sale, however, we’ve been putting things down in our basement throughout the winter to sell in a spring time garage sale once the time comes.

No new ideas, unfortunately. I interviewed for a 2nd job back in the fall to be a pizza delivery boy, but I never got a call back, thankfully now that I look back on it. There’s a couple of reason I haven’t burnt out yet- 1) I only have 1 job. If I were working 2 or more jobs, I could see how people would go crazy doing that. With one job, I still have my hobbies that I focus on that keep me from being 100% focused on my debt. 2) the fear of having something happen (lost job, debilitating injury, etc) while I’m in such debt with such little savings is greater than the impatience I feel every so often. I keep telling myself “what’s another 20 months”? With that thought in mind, I’ve been able to stay really motivated and keep my costs pretty low.